Introduction

Need some quick cash? Whether it’s to tackle credit card debt, make a big purchase, cover an unexpected expense, or fund something major like a wedding or home upgrades, you don’t always have to step into a bank or deal with endless paperwork. Nowadays, it’s as simple as a few taps on your phone — and bam, the money’s in your account, sometimes even on the same day.

With the rise of fintech and online lenders, getting a loan in the USA has never been quicker or easier. But with that ease comes a need for caution — it’s essential to choose the right platform, understand the terms, and borrow responsibly.

In this guide, I’ll go over:

- The different types of online and mobile loan platforms in the U.S.

- Some of the best and most reliable platforms for 2025 — what they offer, who they cater to, and how they operate.

- Tips on choosing a good loan app — key features and warning signs to watch for.

- Strategies to snag the best deal, steer clear of common pitfalls, and manage your loans wisely.

Think of this as your guide to navigating the online lending landscape in America. Let’s dive in.

Why Online Loan Apps Are Gaining Popularity in the USA

Borrowing online is quickly becoming the norm in the United States, and there are a few reasons behind this trend:

- Speed & Convenience: Traditional bank loans often require in-person visits, lots of paperwork, and lengthy processing times. Online platforms let you apply whenever you want, from wherever you are — and you could see approval and cash in hand within hours or even a day.

- Variety: Online lenders frequently offer an array of loan options — personal loans, debt consolidation loans, credit-builder loans, cash advances, lines of credit, and more.

- Inclusivity: Some platforms use innovative methods for assessing creditworthiness — like looking at alternative data or AI-based evaluations — which can help those with thin credit histories get approved.

- Transparency: Many apps provide a straightforward online application process, clear terms, and fast fund disbursal, making the whole borrowing experience easier.

- Quick Access for Emergencies: For urgent cash needs, online platforms can provide funds without collateral and with less delay than traditional banks.

Given these benefits, online loans can be powerful tools — if you use them wisely.

What to Consider Before Using an Online Loan Platform

Because convenience can sometimes come with risks, make sure the platform meets these criteria before you click “Apply”:

- Legitimacy & Transparency — Ensure the lender is registered and the loan terms (like APR, fees, and penalties) are clearly stated.

- Fair Interest Rates & Fees — Compare APRs, origination fees, and any late penalties. If an offer seems too good to be true, be skeptical.

- Secure Application Process — Look for strong security measures, proper encryption, and clear identity verification practices.

- Clear Requirements — Understand eligibility criteria and whether the platform accepts lower credit scores or uses alternative evaluation methods.

- Flexible Loan Options — The platform should provide a range of loan amounts and terms to fit your needs.

- User Reviews & Reputation — Check what past borrowers have to say about their experiences regarding service quality and support.

- Payment Tools — Look for automatic payment options or clear scheduling to help avoid missed payments.

If a platform doesn’t meet these criteria, proceed with caution.

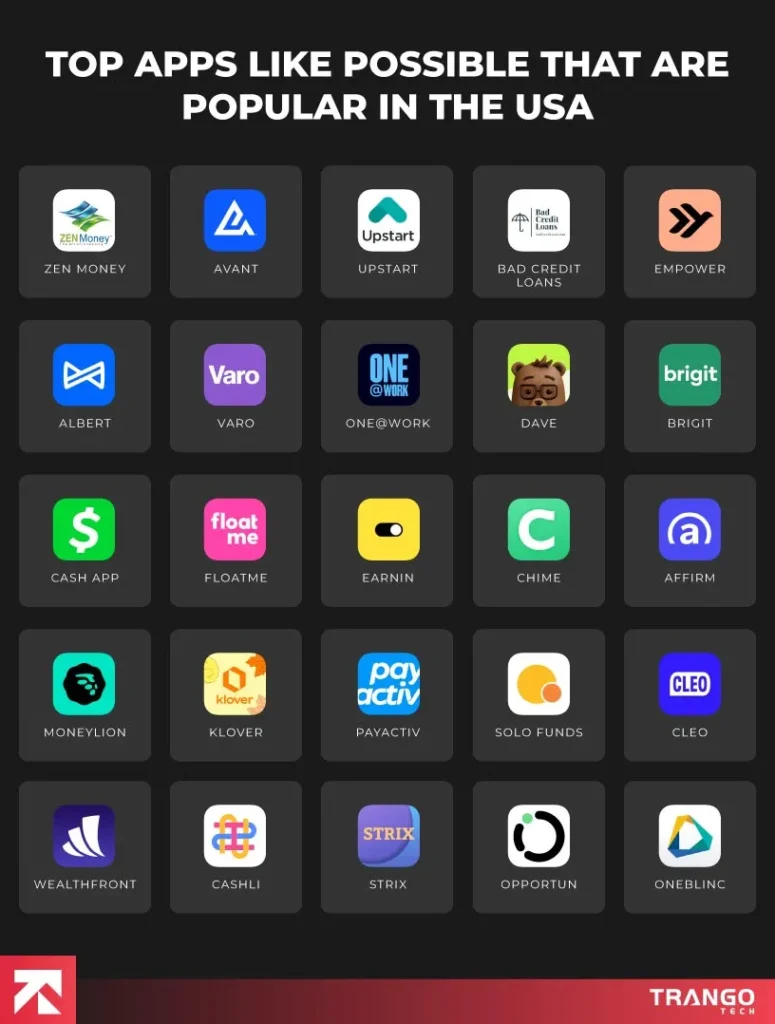

Best Apps & Online Platforms for Loans in the USA (2025 Choices)

Here’s a closer look at some of the most trusted loan apps and platforms that are highly rated as of 2025. They serve a range of borrowers, whether you need a small cash advance or a larger personal loan or debt consolidation.

SoFi — Comprehensive Fintech with Flexible Loans

What makes it shine:

- SoFi provides personal loans with competitive rates and no hidden fees, all online.

- Loan amounts range from $5,000 to $100,000, good for things like debt consolidation or major expenses.

- Offers flexible repayment terms, usually between 2 and 7 years.

- Many users appreciate added features such as financial planning help and unemployment protection on some loans, all under one roof.

Ideal For: Folks with decent credit looking for larger loans from a trustworthy lender.

If you want to create AI Ads you can visit: https://adscribe.online

Upstart — AI-Driven Lending for Limited Credit Histories

What sets Upstart apart:

- Upstart uses AI and alternative data points, like education and job history, to assess borrowers — which means you might get approved even if your credit history isn’t extensive.

- Loan amounts range from $1,000 to $50,000, suitable for small to medium personal loans.

- Fast application and funds, with many getting money as soon as the next business day after approval.

- No prepayment penalties if you want to pay off your loan early.

Ideal For: Young people, freelancers, gig workers, or anyone needing a flexible loan despite limited credit history.

LendingPoint — Quick Funding for Fair-Credit Borrowers

What LendingPoint offers:

- Personal loans up to $36,500 or more.

- Many borrowers receive funding the same day they’re approved, especially if they meet necessary criteria.

- Accepts mid-range credit scores, not just those with perfect credit.

- The application process is mostly online, with a soft credit check for prequalification, so you can see rates without dinging your score.

Ideal For: Borrowers with fair to good credit needing a reasonable amount quickly.

Prosper Marketplace — Peer-to-Peer Lending for Personal Loans

Why Prosper is appealing:

- As one of the first peer-to-peer lending platforms in the U.S., Prosper connects borrowers with individual or institutional investors.

- You can request unsecured personal loans, often up to $50,000.

- Repayment typically spans 3 to 5 years, with no prepayment penalties.

- The platform allows you to pre-qualify, compare rates, and see estimated monthly payments, all online.

Ideal For: Those who prefer peer-to-peer lending, which can sometimes offer greater flexibility than traditional loans.

LendingTree — Loan Marketplace for Comparing Lenders

What LendingTree provides:

- It operates as a marketplace rather than just a lender. You input your loan needs, and it presents multiple lenders with their rates and terms for comparison.

- This makes it easier to shop around and find the best deal for your financial situation.

- It’s especially useful if you’re unsure of the best option or have a not-so-standard credit profile.

Ideal For: Borrowers wanting to compare multiple offers and find the optimal rate.

MoneyLion, Brigit, Chime (SpotMe) & Other Cash-Advance Apps — For Short-Term Needs

If you just need a little cash quickly — maybe to bridge a paycheck gap or handle an emergency — these platforms might be better suited than larger personal loans:

- MoneyLion offers personal and credit-builder loans, combining banking, credit, and investment options.

- Brigit provides cash advances for short-term liquidity, often helpful to prevent overdrafts.

- Chime’s SpotMe offers overdraft protection or small cash advances for eligible users.

Ideal For: Those with short-term financial needs or unpredictable income looking to avoid high-interest loans.

Choosing the Right Loan Platform

With so many options, finding the right loan platform can be daunting. Here’s a straightforward way to help you decide:

Your SituationRecommended Platform Type

Long-term financing (like home improvements) and stable credit: SoFi, LendingPoint, Prosper, LendingTree (for comparing larger offers)

Medium/small personal loan, limited credit history: Upstart, LendingPoint, peer-to-peer via Prosper

Comparing lenders for the best rate/terms: LendingTree (marketplace)

Short-term cash flow, small emergencies: MoneyLion, Brigit, Chime (SpotMe)

Debt consolidation/credit card payoff: SoFi, LendingPoint, Prosper, LendingTree

Looking for alternative financing instead of bank loans: Prosper (peer-to-peer), Upstart (alternative data)

Before You Apply, Keep in Mind:

- Pre-qualify first to see potential terms without affecting your score.

- Compare APR instead of just the interest rate — include all fees.

- Set up automatic payments to avoid missed deadlines.

- Only borrow what you really need.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/whats-a-loan-guide-to-smart-borrowing/

Risks to Be Aware Of — and How to Steer Clear

Although online loan apps offer great convenience, they come with risks. Here’s what to watch out for:

⚠️ High Interest & Hidden Fees

Some lenders may advertise attractive quick loans but slap on high APRs, origination fees, or hefty late payment penalties. Always read the fine print.

⚠️ Short-Term Debt Cycles

Some cash-advance or payday apps can lead to repeated borrowing, creating a cycle of debt that’s hard to escape, especially if your income fluctuates.

⚠️ Credit Score Impacts

Missing payments or defaulting on loans can damage your credit just as much as with traditional lenders.

⚠️ Scams & Unregulated Lenders

Be cautious of questionable apps claiming to offer loans. Always verify that a lender is legit and complies with regulations, and check their data privacy practices.

⚠️ Overborrowing

Just because you’re approved for a high amount doesn’t mean you should take it. Overextending can lead to long-term financial strain.

Staying Safe:

- Stick to reputable platforms that have good reviews.

- Avoid lenders asking for upfront fees before releasing funds.

- Start with pre-qualification instead of diving straight into applications.

- Pay attention to loan terms (APR, fees).

- Only borrow what you truly need, and strategize for repayment beforehand.

Scenarios — Finding the Right Fit

💡 Scenario 1: Need $20,000 for Credit Card Debt Consolidation

Best options: SoFi or LendingPoint — Both can provide mid-to-large personal loans, simplifying your payment process by replacing high-interest credit cards with a fixed-rate loan.

💡 Scenario 2: Freelancer with No Credit History — Need $5,000

Best choice: Upstart — Its AI-driven assessment is more open to those with limited credit history.

💡 Scenario 3: Quick $2,000–$5,000 for an Emergency

Best options: MoneyLion for a small personal loan, or apps like Brigit or Chime for small advances.

💡 Scenario 4: Comparing Offers for the Best Rate

Best choice: LendingTree — You can input your info and receive multiple offers to compare.

💡 Scenario 5: Prefer Peer-to-Peer Lending

Best option: Prosper Marketplace — It connects you to individual or institutional investors for personal loans, often with added flexibility.

Tips for First-Time Online Borrowers

If it’s your first time borrowing online, here are some quick tips to help you navigate:

- Pre-qualify first to get an idea of rates and limits before jumping in.

- Look beyond just the interest rate — consider the full cost (APR + fees).

- Stick to what you actually need — avoid the urge to take out more just because you can.

- Set reminders for payments or opt for automatic debits to avoid missing due dates.

- Read the fine print of the loan agreement.

- Limit applications to one at a time to protect your credit score from multiple hard checks.

- If you have limited credit, check platforms like Upstart.

- For small, short-term needs, use cash advance apps instead of bigger personal loans.

- Be wary of lenders asking for upfront payments — that’s a major red flag.

- Treat loans as tools, not a pathway to overspending. Borrow responsibly.

The Future of Online Lending

The online lending landscape is changing rapidly, and here are some trends to keep an eye on:

- Increased reliance on AI and alternative data to help those with limited credit access funds.

- More integration of banking, financial planning, and investing into “super-apps.”

- Development of more personalized loan options like credit-builder loans or flexible repayment plans.

- Enhanced regulation and transparency to protect consumers.

- Growth in peer-to-peer and community lending as viable alternatives to traditional loans.

If approached wisely, online lending can greatly expand access to credit, making it fairer and more efficient.

Final Thoughts

Digital loans are here to stay, offering a powerful way to access funds, whether it’s for an unexpected bill or a significant purchase. But a loan isn’t just about getting money — it’s a commitment that requires responsibility and careful planning.

Before you click “Apply,” think about your needs, ensure you understand what you’re agreeing to, and prepare a repayment plan. Used wisely, loans can help you navigate life’s ups and downs. Used carelessly, though, they may lead to financial strain.

So, take your time, choose wisely, and borrow only what you need. Here’s to responsible borrowing and steady financial growth!

Leave a Reply to How Interest Rates on Loans are Calculated: The Ultimate Guide to Understanding EMI – Fundica Investments Cancel reply