Introduction: Why Reducing Your Home Loan EMI Matters More Than Ever

A home loan is often the largest financial responsibility in a person’s life. While owning a home brings pride and security, the monthly EMI (Equated Monthly Installment) can quietly become a long-term burden if not managed wisely. Rising living costs, unexpected expenses, career changes, or interest rate hikes can make even a well-planned EMI feel heavy over time.

The good news?

You don’t need to default, bend rules, or take risky shortcuts to reduce your home loan EMI. There are completely legal, ethical, and lender-approved ways to bring down your EMI—sometimes significantly—without harming your credit score or financial stability.

This detailed guide explains how to reduce your home loan EMI legally, step by step, using smart financial planning, lender negotiations, and better loan management. Whether you are a first-time homebuyer, a salaried professional, or a self-employed borrower, these strategies can help you regain control of your finances.

Understanding Home Loan EMI Before Reducing It

Before trying to reduce your EMI, it’s important to understand what actually determines your EMI.

A home loan EMI depends mainly on four factors:

- Loan Amount (Principal)

- Interest Rate

- Loan Tenure

- Type of Interest (Fixed or Floating)

Even a small change in any one of these can affect your EMI substantially. Most legal EMI-reduction strategies work by adjusting one or more of these factors.

If you want to create AI Ads you can visit: https://adscribe.online

What Does “Reducing EMI Legally” Really Mean?

Reducing EMI legally means:

- Following bank rules and loan agreements

- Using lender-approved options

- Maintaining a good credit record

- Avoiding defaults or penalties

It does not mean skipping payments or manipulating documents. In fact, legal EMI reduction often improves your credit profile when done correctly.

Strategy 1: Extend Your Home Loan Tenure

How It Works

Increasing the loan tenure spreads the remaining loan amount over more years, which directly reduces the EMI.

Example

- Outstanding loan: ₹40 lakh

- Remaining tenure: 15 years

- EMI: ₹41,000

- Extend tenure to 25 years → EMI drops to ~₹32,000

Pros

- Immediate EMI relief

- Better monthly cash flow

- Useful during income uncertainty

Cons

- Higher total interest paid

- Longer debt duration

Best For

- Borrowers facing temporary cash-flow issues

- Individuals expecting income stability later

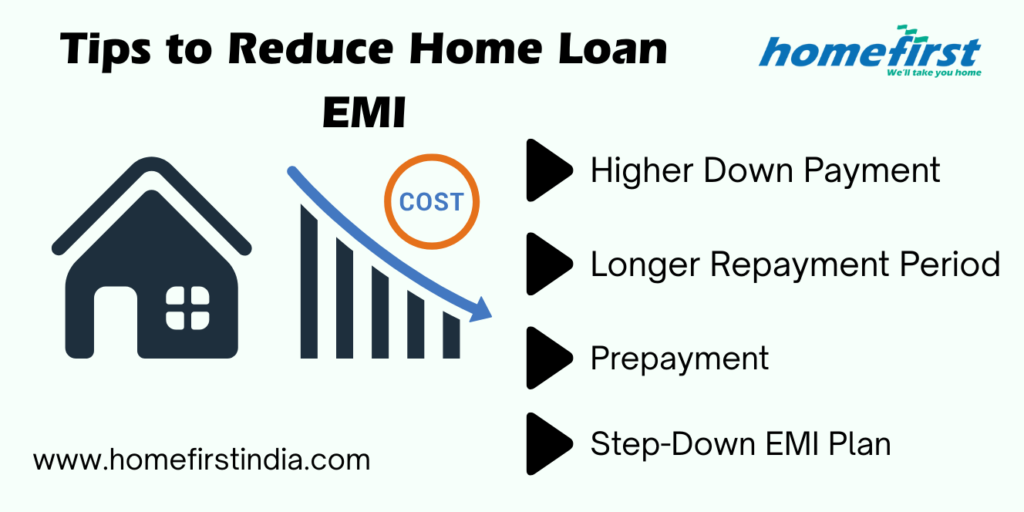

Strategy 2: Make Partial Prepayments (Even Small Ones)

Why Prepayment Is Powerful

Any extra amount you pay directly reduces the principal, which lowers future interest and EMI.

Key Insight

Even small, regular prepayments can save lakhs in interest over time.

Example

Paying ₹50,000 extra once a year can reduce:

- Loan tenure by several years or

- EMI significantly over time

Legal Advantage

Most floating-rate home loans allow zero-penalty prepayments.

Best For

- Salaried individuals receiving bonuses

- Self-employed borrowers with seasonal income

Strategy 3: Switch from Fixed to Floating Interest Rate

Why This Helps

Floating rates are usually lower than fixed rates, especially when market interest rates are stable or falling.

What to Do

- Request rate conversion from your lender

- Or opt for a balance transfer to a floating-rate loan

Risk to Understand

Floating rates can rise in the future, increasing EMI.

Best For

- Long-term borrowers

- Those comfortable with some EMI fluctuation

Strategy 4: Negotiate Interest Rate with Your Existing Lender

Many borrowers don’t realize this—but banks are open to negotiation, especially if:

- You have a good repayment history

- Your credit score has improved

- New borrowers are getting lower rates

How to Negotiate

- Show competing lender offers

- Request a rate reset or re-pricing

- Ask about loyalty discounts

Cost Involved

Some banks charge a small conversion fee, but savings usually outweigh the cost.

Strategy 5: Opt for a Home Loan Balance Transfer

What Is a Balance Transfer?

Moving your remaining loan to another lender offering lower interest rates.

How It Reduces EMI

Lower interest rate = lower EMI or shorter tenure.

When It Makes Sense

- More than 50% of loan tenure remaining

- Interest rate difference ≥ 0.5%

- Outstanding loan amount is significant

Costs to Consider

- Processing fees

- Legal and valuation charges

Always calculate net savings before transferring.

Strategy 6: Improve Your Credit Score (Yes, Even After Loan Approval)

Your credit score continues to matter even after you take a home loan.

How Credit Score Affects EMI

A higher score helps you:

- Negotiate lower interest rates

- Get faster approval for balance transfer

- Avoid higher risk premiums

Ways to Improve Credit Score

- Pay EMIs on time

- Reduce credit card balances

- Avoid multiple loan inquiries

- Maintain low credit utilization

Over time, this gives you leverage to legally reduce EMI.

Strategy 7: Convert to Step-Up or Step-Down EMI Structure

Step-Up EMI

Lower EMIs initially, increasing gradually as income grows.

Step-Down EMI

Higher EMIs initially, reducing later.

Who Benefits

- Young professionals expecting salary growth

- Borrowers planning career progression

This option requires lender approval but is completely legal.

Strategy 8: Use Windfall Income Smartly

Windfall income includes:

- Bonuses

- Incentives

- Gifts

- Inheritance

- Investment maturity

Instead of spending it all, use a portion to:

- Prepay principal

- Reduce EMI or tenure

This is one of the fastest legal ways to reduce EMI burden.

Strategy 9: Add a Co-Applicant with Strong Income

Adding a spouse or family member as a co-applicant can:

- Increase combined income

- Improve loan eligibility

- Help negotiate better terms

This may allow:

- EMI restructuring

- Interest rate reduction

Strategy 10: Convert Loan to Longer Amortization with Periodic Review

Some lenders allow flexible amortization, where:

- EMI is reviewed annually

- Adjusted based on repayment behavior

This helps borrowers manage EMI without defaulting.

Strategy 11: Avoid EMI Bounce at All Costs

Even one EMI bounce can:

- Damage credit score

- Increase interest burden

- Reduce negotiation power

Maintaining a clean repayment record gives you strong leverage to request EMI reduction options legally.

Strategy 12: Use Tax Savings to Offset EMI Pressure

Tax benefits don’t reduce EMI directly, but they reduce net outflow.

Common Deductions

- Principal repayment (Section 80C)

- Interest payment (Section 24)

Use tax refunds to:

- Prepay loan

- Build emergency buffer

Strategy 13: Review Your Loan Every 2–3 Years

Many borrowers forget to review their loan after disbursement.

Regular review helps you:

- Track interest rate changes

- Identify better offers

- Act before EMI stress builds

A home loan should evolve with your financial life.

Mistakes to Avoid While Trying to Reduce EMI

- Extending tenure blindly without calculation

- Ignoring total interest cost

- Choosing lower EMI over long-term savings

- Falling for “zero-cost” transfer claims

- Missing EMI during transition

Reducing EMI should not create future financial traps.

How Much EMI Reduction Is Realistically Possible?

Depending on your loan size and strategy, EMI reduction can range from:

- 5% (minor restructuring)

- 15–25% (interest reduction + tenure extension)

- Even higher with prepayments

The key is combining multiple legal strategies instead of relying on one.

Who Should Focus More on EMI Reduction?

You should prioritize EMI reduction if:

- Your EMI exceeds 40% of income

- Income is unstable

- You have multiple financial responsibilities

- Interest rates have fallen significantly since loan start

Who Should Avoid Aggressive EMI Reduction?

Avoid extreme EMI reduction if:

- You are close to loan completion

- You have surplus cash for prepayment

- You aim to close the loan early

In such cases, tenure reduction may be smarter than EMI reduction.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/interest-only-home-loans/

EMI Reduction vs Loan Closure: Which Is Better?

| Situation | Better Option |

|---|---|

| Cash flow stress | EMI reduction |

| Surplus savings | Prepayment |

| Near retirement | Loan closure |

| Early loan stage | Balance transfer |

Frequently Asked Questions

Is EMI reduction allowed by banks?

Yes, through tenure extension, restructuring, or balance transfer.

Will EMI reduction affect credit score?

No, if done legally and EMIs are paid on time.

Can EMI be reduced multiple times?

Yes, subject to lender policies.

Is reducing EMI better than reducing tenure?

Depends on your financial goals.

Final Thoughts: Reducing Your Home Loan EMI Is a Smart Financial Move

Reducing your home loan EMI legally is not about escaping responsibility—it’s about managing debt wisely. Life changes, income fluctuates, and financial priorities evolve. Your home loan should adapt accordingly.

With the right mix of:

- Smart negotiation

- Strategic prepayment

- Timely review

- Financial discipline

you can significantly reduce EMI pressure without harming your long-term wealth.

Remember, a home loan should support your life—not control it.

Leave a Reply to Home Loan Pre-Approved vs Pre-Qualified: What’s the Real Difference & Which One Should You Choose? – Fundica Investments Cancel reply