Introduction: Why “Pre-Approved” and “Pre-Qualified” Home Loans Confuse Most Homebuyers

If you’ve ever searched for a home loan or spoken to a bank representative, chances are you’ve heard these two terms:

- Home Loan Pre-Qualified

- Home Loan Pre-Approved

At first glance, they sound almost identical. Many people even assume they mean the same thing. But in reality, the difference between pre-qualified and pre-approved home loans can significantly impact your home-buying journey—your budget, your negotiation power, and even whether your deal goes through or not.

For first-time homebuyers especially, misunderstanding these terms can lead to disappointment, wasted time, or financial stress. Imagine thinking you’re ready to buy a house, only to find out later that the loan amount you “expected” isn’t actually guaranteed.

This detailed guide explains home loan pre-approved vs pre-qualified in a clear, human-friendly way—no banking jargon, no confusion. By the end, you’ll know exactly:

- What each term means

- How they work

- Their pros and cons

- Which one you should choose based on your situation

Whether you’re just starting to explore buying a home or you’re already house-hunting, this article will help you move forward with clarity and confidence.

What Does “Pre-Qualified” Mean in a Home Loan?

Let’s start with the simpler of the two.

Home Loan Pre-Qualification: Simple Explanation

A home loan pre-qualification is an initial estimate given by a lender about how much loan you might be eligible for—based mainly on self-reported financial information.

In simple words:

Pre-qualification is an informal, quick assessment that gives you a rough idea of your borrowing capacity.

It is not a guarantee of loan approval.

If you want to create AI Ads you can visit: https://adscribe.online

How Home Loan Pre-Qualification Works

The pre-qualification process is usually quick and easy.

What You Share

- Approximate income

- Existing EMIs or debts

- Employment type

- Estimated credit score

What the Lender Does

- Uses basic formulas

- Does not deeply verify documents

- May or may not pull your credit report

What You Get

- An estimated loan amount

- A general idea of EMI affordability

In many cases, this can be done online in minutes.

Key Characteristics of Home Loan Pre-Qualification

- Informal process

- Minimal or no documentation

- Fast and easy

- No property details required

- Not legally binding

- No strong impact on credit score

Pre-qualification is often used as a starting point, not a final decision.

What Does “Pre-Approved” Mean in a Home Loan?

Now let’s move to the more serious and powerful option.

Home Loan Pre-Approval: Simple Explanation

A home loan pre-approval is a conditional approval given by a lender after verifying your financial details and credit profile.

In simple words:

Pre-approval means the bank has already checked your finances and is willing to lend you a specific amount—subject to final conditions.

It carries much more weight than pre-qualification.

How Home Loan Pre-Approval Works

Pre-approval involves a detailed evaluation process.

What You Submit

- Identity proof

- Income documents

- Bank statements

- Employment or business proof

- Credit score access

What the Lender Does

- Verifies documents

- Checks credit history

- Assesses repayment capacity

- Performs risk analysis

What You Get

- A written pre-approval letter

- Confirmed loan eligibility amount

- Validity period (usually 3–6 months)

Key Characteristics of Home Loan Pre-Approval

- Formal process

- Document verification required

- Credit score is checked

- Higher credibility

- Improves negotiation power

- Still subject to property verification

Pre-approval brings you much closer to actual loan disbursement.

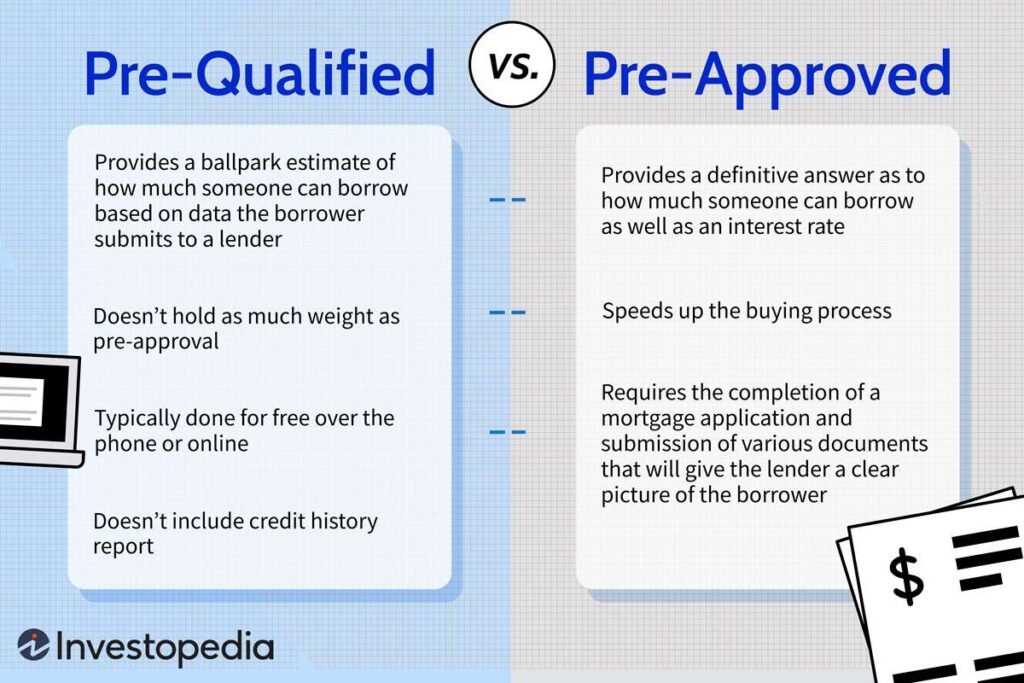

Home Loan Pre-Approved vs Pre-Qualified: Core Difference Explained

Let’s clearly break down the difference.

| Feature | Pre-Qualified | Pre-Approved |

|---|---|---|

| Process type | Informal | Formal |

| Document verification | No | Yes |

| Credit check | Minimal or none | Detailed |

| Accuracy | Approximate | Highly accurate |

| Loan guarantee | No | Conditional yes |

| Time required | Minutes | Few days |

| Impact on credit score | Negligible | Small impact |

| Seller confidence | Low | High |

Why Pre-Qualification Exists at All

You might wonder—if pre-approval is better, why do banks even offer pre-qualification?

Purpose of Pre-Qualification

- Helps first-time buyers understand affordability

- Encourages early engagement with lenders

- Provides quick clarity without paperwork

- Serves as an educational step

Pre-qualification is meant for exploration, not commitment.

Why Pre-Approval Is More Powerful in Real Home Buying

Pre-approval changes how sellers and agents view you.

Benefits of Being Pre-Approved

- Sellers take you seriously

- Faster deal closure

- Stronger negotiation position

- Reduced risk of loan rejection later

In competitive housing markets, pre-approval can make the difference between winning and losing a deal.

Does Pre-Approval Guarantee a Home Loan?

This is one of the most common misunderstandings.

Short Answer

No, pre-approval is not a final guarantee, but it’s very close.

Why It’s Still Conditional

Final approval depends on:

- Property legal clearance

- Property valuation

- No major change in your income or credit profile

If everything remains stable, pre-approval usually converts into final approval smoothly.

Credit Score Impact: Pre-Qualified vs Pre-Approved

Pre-Qualification

- Often uses soft checks

- Little to no impact on credit score

Pre-Approval

- Uses hard credit inquiry

- May cause a small, temporary dip

However, a single pre-approval inquiry is generally harmless if you maintain good repayment habits.

Which One Should You Choose? (Practical Scenarios)

Let’s look at real-life situations.

Scenario 1: First-Time Buyer Just Exploring

Best option: Pre-Qualification

Why:

- No pressure

- No documentation hassle

- Helps set expectations

Scenario 2: Actively Searching for a Home

Best option: Pre-Approval

Why:

- Confident budget planning

- Serious buyer image

- Faster transactions

Scenario 3: Buying in a Competitive Market

Best option: Pre-Approval

Why:

- Sellers prefer pre-approved buyers

- Better negotiation power

Scenario 4: Income Is Irregular

Best option: Start with pre-qualification, then pre-approval

Why:

- Understand limits first

- Avoid rejection stress

How Long Are Pre-Qualified and Pre-Approved Loans Valid?

Pre-Qualification

- Usually valid for a short time

- Needs re-evaluation if finances change

Pre-Approval

- Valid for 3–6 months

- Can be renewed if required

If interest rates change significantly, lenders may revise terms.

Common Myths About Pre-Qualified and Pre-Approved Home Loans

Myth 1: They Are the Same

Reality: They serve very different purposes.

Myth 2: Pre-Approval Means Loan Is Final

Reality: Property approval is still pending.

Myth 3: Pre-Qualification Guarantees EMI

Reality: It’s only an estimate.

Myth 4: Pre-Approval Is Risky

Reality: It’s safe when done with stable finances.

Advantages of Getting Pre-Approved Early

- Better financial discipline

- Realistic home search

- Avoid emotional overspending

- Faster loan processing

- Less last-minute stress

Pre-approval helps you buy a home within your means, not just your dreams.

Disadvantages to Be Aware Of

Pre-Qualification Drawbacks

- Can create false confidence

- Loan amount may change later

Pre-Approval Drawbacks

- Requires paperwork

- Time-bound validity

- Credit inquiry involved

Knowing these limitations helps set realistic expectations.

How to Improve Your Chances of Pre-Approval

- Maintain credit score above 700

- Reduce existing EMIs

- Avoid job changes during application

- Keep documents ready

- Avoid multiple loan inquiries

Preparation makes pre-approval smoother and stronger.

Pre-Approved vs Pre-Qualified for Self-Employed Borrowers

Self-employed individuals often face stricter checks.

Pre-Qualification

- Useful for initial estimation

- Helps understand lender expectations

Pre-Approval

- Requires stable income proof

- Strong business continuity needed

In such cases, pre-qualification is a good starting point.

Does Pre-Approval Lock Your Interest Rate?

Usually:

- No permanent lock

- Some lenders offer temporary rate lock

- Final rate depends on market conditions

Always confirm rate-lock terms clearly.

Should You Get Pre-Approved Before Finalizing Property?

Yes—ideally.

Why?

- Prevents budget mismatch

- Avoids rejection after booking

- Saves time and money

Pre-approval before property selection is a smart buyer move.

Pre-Approved Home Loan vs Sanction Letter

These are often confused.

| Aspect | Pre-Approval | Sanction Letter |

|---|---|---|

| Stage | Before property | After property |

| Property details | Not required | Mandatory |

| Finality | Conditional | Near-final |

Pre-approval comes first, sanction later.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/how-to-reduce-your-home-loan/

How Real Estate Agents View Pre-Approved Buyers

Agents often prefer pre-approved buyers because:

- Higher closing probability

- Faster documentation

- Serious intent

This gives you an advantage in negotiations.

Can You Be Pre-Approved by Multiple Banks?

Yes, but:

- Multiple credit inquiries can affect score

- Choose 1–2 lenders wisely

- Compare offers carefully

Avoid applying everywhere at once.

Final Checklist: Pre-Qualified or Pre-Approved?

Choose Pre-Qualification if:

- You’re just starting

- You want rough estimates

- You’re unsure about timelines

Choose Pre-Approval if:

- You’re actively buying

- You want certainty

- You need negotiation power

Conclusion: Pre-Approved vs Pre-Qualified—Know the Difference, Buy with Confidence

Understanding the difference between home loan pre-approved and pre-qualified can save you from confusion, disappointment, and financial mistakes. While pre-qualification is a helpful first step, pre-approval is what truly empowers you as a homebuyer.

Think of it this way:

- Pre-qualification tells you what might be possible

- Pre-approval tells you what is realistically achievable

A home purchase is a major life decision. The more clarity you have at the start, the smoother your journey will be.

When you choose the right option at the right time, you don’t just buy a house—you buy peace of mind.

Leave a Reply to For Home Loans & Other Loans, Floating vs Fixed Rate: Which Is Better in 2026? – Fundica Investments Cancel reply