Introduction: Why This Question Matters More in 2025 Than Ever

Interest rates—whether floating or fixed—are a core part of almost every loan decision you will make as a borrower. This choice affects your monthly budget, long-term financial planning, total interest cost, and even your peace of mind.

But with changing economic conditions, fluctuating interest rate cycles, and evolving financial markets post-pandemic, the big question for 2025 is:

Which is better right now—floating or fixed interest rates?

And more importantly: How do you choose the right one for your financial situation?

This comprehensive guide explains:

- What fixed and floating rates really mean

- How they work in the real world

- Pros and cons of each

- What’s happening with interest rates in 2025

- Which option makes sense for different borrowers

- How to choose wisely (step-by-step)

By the end, you’ll understand not just the technical differences, but how these choices directly impact your money, emotions, and lifestyle.

Let’s begin.

Chapter 1: What Are Fixed and Floating Interest Rates? (Simple Explanation)

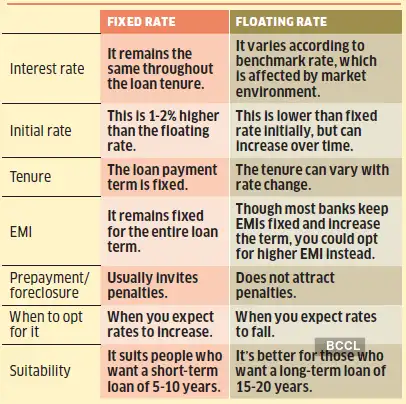

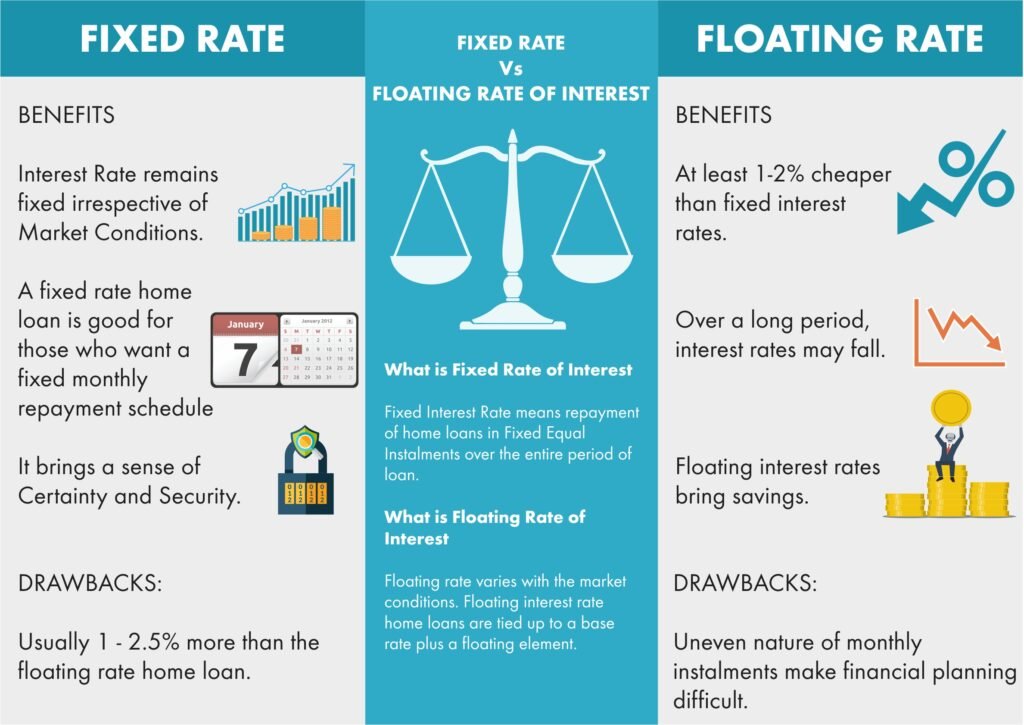

What Is a Fixed Interest Rate?

A fixed interest rate stays the same throughout your loan tenure.

If you take a loan at 8% fixed, it stays 8% till the end.

Key Features

✔ EMI remains the same month after month

✔ Predictable financial planning

✔ Protection from future rate hikes

It’s like locking your interest rate for the full loan period.

If you want to create AI Ads you can visit: https://adscribe.online

What Is a Floating (Variable) Interest Rate?

A floating interest rate changes with market conditions.

Example:

📌 Base rate today: 8%

📌 If market rates rise → Your loan rate rises

📌 If market rates fall → Your loan rate falls too

Floating rates fluctuate based on:

- Central bank policies

- Inflation trends

- Economic growth

- Money supply in the economy

So your EMI may go up or down over time.

Why This Choice Matters More in 2025

In the past few years:

✔ Interest rates went up due to inflation

✔ Economies adjusted after pandemic disruptions

✔ Central banks took different approaches

Many borrowers now face higher borrowing costs than before.

This makes the fixed vs floating decision more crucial—especially if you are taking or refinancing a loan in 2025.

Chapter 2: How Interest Rates Affect Your Loan Payments

When you borrow money, your interest rate directly affects:

- Monthly EMI

- Total interest paid over the loan tenure

- Your monthly cash flow

- Your savings on prepayment

- Your financial stress

Let’s break it down:

EMI Formula (Simplified)

Your EMI is determined by:

- Loan amount

- Interest rate

- Loan tenure

Higher interest rate → Higher EMI

Lower interest rate → Lower EMI

So even a 0.5% difference in interest can save or cost you thousands every month.

Total Interest Paid

Interest is not linear—early EMIs pay more interest, and later EMIs pay more principal.

With floating rates, your total interest depends on:

- How long the rate stays high

- How often the rate resets

With fixed rates, your total interest is predictable upfront.

Chapter 3: Fixed Rate – What You Get & What You Give Up

Advantages of a Fixed Interest Rate

🧠 1. Predictability

Your EMI remains constant—no surprises.

This is ideal for:

- Monthly budgeting

- Families with fixed income

- People averse to risk

📊 2. Protection Against Future Rate Hikes

If market interest rates rise, you benefit from the stability of fixed rates.

Imagine:

- You borrow at 7.5% fixed

- Market rates rise to 9%

Your EMI won’t change a bit.

That’s peace of mind.

🏠 3. Great for Long-Term Planning

If you plan to hold your loan for decades (e.g., a home loan), fixed rates help you:

- Calculate total cost accurately

- Avoid financial surprises

- Sleep better at night

Disadvantages of a Fixed Interest Rate

💸 1. Initial Rates Are Usually Higher

Lenders charge a premium to offer stability.

So you might start with a higher rate than floating.

📉 2. No Benefit When Rates Fall

If market rates drop, your fixed rate doesn’t change.

You’ll miss out on potential savings.

⚠ 3. Prepayment or Conversion Charges

Some lenders charge extra if you want to switch before tenure ends.

Chapter 4: Floating Rate – What You Get & What You Give Up

Advantages of a Floating Interest Rate

💰 1. Lower Starting Interest

Floating rates usually start lower than fixed.

This means:

- Lower initial EMI

- Better cash flow early on

📉 2. Benefit When Rates Fall

If the economy slows or inflation cools, rates may be cut.

Floating borrowers benefit directly.

💡 3. No or Low Prepayment Charges

Most floating-rate loans allow you to:

- Prepay without penalty

- Convert easily

- Refinance later

Disadvantages of a Floating Interest Rate

📈 1. EMI Goes Up When Rates Rise

This is the biggest risk.

Your monthly outflow can suddenly increase.

📊 2. Harder to Plan Long-Term Budgets

Uncertainty makes it tougher to plan:

- Investments

- EMIs

- Expenses

🧨 3. Can Be Risky for Fixed-Income Earners

If your income is steady but not rising fast, floating rate shocks can hurt.

Chapter 5: Floating vs Fixed Rates in 2025 – What’s Happening in the Market?

To decide which is better in 2025, we need to understand the current interest rate environment. Interest rate trends change based on global and local economic conditions.

Here’s what has been influencing rates:

📍 1. Post-Pandemic Inflation Trends

Countries worldwide experienced inflation spikes after the pandemic.

To control inflation, central banks raised rates.

📍 2. Economic Recovery & Growth Rates

As growth stabilizes, central banks may pause rate hikes or even cut rates if growth slows.

📍 3. RBI / Fed Policies

Major decision-making bodies adjust key rates based on:

- Inflation data

- Employment trends

- Growth forecasts

As of early 2025:

- Some economies are showing signs of easing

- Inflation pressures are moderating

- Central banks may consider rate cuts if conditions improve

This environment makes the floating rate more attractive because:

✔ Potential for future rate reductions

✔ Lower overall borrowing cost if rates fall

However, no one can predict market movements perfectly.

Chapter 6: Fixed vs Floating for Different Loan Types

Let’s look at common loan types and which rate choice tends to work better for each.

1. Home Loans

Fixed Rate

✔ Good for stable budgeting

✔ Ideal if rates are low when you borrow

Floating Rate

✔ Can save more if rates drop

✔ Suitable for long-term loans

✔ Allows prepayment without penalty

2025 Outlook for Home Loans

With inflation cooling and markets stabilizing, floating rates may offer long-term savings, but fixed rates can still be reassuring for risk-averse borrowers.

Verdict: Floating may be a slightly better option overall in 2025 — but only if you can handle occasional EMI changes.

2. Personal Loans

Most personal loans are either:

- Short tenure (1–5 years)

- High interest rates

Fixed Rate is usually better because:

✔ No rate fluctuations

✔ Simple budgeting

Floating Rate is rare for personal loans.

3. Car Loans

These are also short-term loans.

Fixed Rate tends to be preferable:

✔ Stability

✔ EMIs predictable

✔ Tenure is short anyway

Floating Rate is less common and risky for such loans.

4. Business Loans

Business loans vary widely.

If the loan is short-term (working capital), fixed rates make sense.

If the loan is long-term, floating can reduce cost.

Chapter 7: Real-Life Examples: How Savings Differ Between Fixed & Floating

Example 1: Home Loan of ₹50 Lakh for 20 Years

Fixed Rate at 8.5%

EMI: ₹43,391

Total Interest: ~₹55 lakh+

Floating Rate at 8% (initially)

EMI: ₹41,971

Potential Savings: ₹1,000–₹2,000/month if rates stay low

Total Savings: Significant over 20 years if rates drop

If rates go up, the opposite effect happens.

Example 2: Short-Term Personal Loan

Fixed at 11%

EMI predictable

Good for budgeting

Floating at 10.5%

Often unpredictable

Not recommended for short loans

Chapter 8: Emotional & Behavioral Psychology of Fixed vs Floating

Most loan decisions are not purely financial—they are emotional.

Some borrowers:

- Fear uncertainty

- Prefer predictability

- Have fixed income

For them, fixed rates feel safer even if they cost more.

Others:

- Are financially confident

- Have rising income

- Can handle temporary EMI increases

For them, floating rates feel smarter.

Your personality, risk tolerance, and financial discipline matter as much as market forecasts.

Chapter 9: How to Choose Between Fixed and Floating—Step-by-Step

Here’s a stepwise method to decide for your own home loan or any loan:

Step 1: Know Your Income Stability

✔ Stable & predictable → Fixed rate feels better

✔ Variable or rising income → Floating may benefit

Step 2: Check Current Market Forecast

✔ If rates are high and expected to fall → Floating

✔ If rates are low but expected to rise → Fixed

Step 3: Check Your Loan Tenure

✔ Short tenure (<5 years) → Fixed

✔ Long tenure (>10 years) → Floating

Step 4: Evaluate Your Risk Tolerance

✔ Fear of change → Fixed

✔ Comfortable with change → Floating

Step 5: Use Online EMI Calculators

Compare total cost in different rate scenarios.

Step 6: Consider Repricing or Conversion Options

Some lenders allow you to switch (sometimes with fees) from fixed to floating and vice versa.

Chapter 10: Tips Before You Finalize Your Decision

Here are practical tips before you choose:

✔ Ask for a “Rate Lock” Option

Some lenders allow locking the rate for a few days.

✔ Negotiate with Lender

A slightly lower fixed rate can be negotiated—especially if you have strong credit.

✔ Understand All Charges

Processing fees, late fees, prepayment charges matter.

✔ Get a Pre-Approval First

Pre-approved loan offers give more clarity.

✔ Consider a Hybrid Approach

Some lenders offer mixed EMIs:

✔ Fixed for initial years

✔ Floating later

This can be optimal if you want predictability AND savings.

Chapter 11: Mistakes to Avoid When Choosing Between Fixed & Floating

❌ Choosing only based on EMI

Don’t forget total interest cost.

❌ Ignoring future income prospects

Your future salary growth matters.

❌ Ignoring economic conditions

Rates react to inflation, GDP, jobs, growth.

❌ Not reading terms & conditions

Always check prepayment and foreclosure rules.

Chapter 12: FAQs (Frequently Asked Questions)

1. Is a floating rate always cheaper than fixed?

Not always. Floating starts lower, but future hikes can make it costlier.

2. Does floating rate affect my credit score?

No, interest type doesn’t affect credit score—repayment behavior does.

3. Can I switch from fixed to floating later?

Yes, many lenders allow it, sometimes with a small fee.

4. Is fixed better for short-term loans?

Yes, fixed is typically better for loans under 5 years.

5. Is floating better if interest rates drop?

Yes—but only if rates stay low for a significant period.

Chapter 13: Fixed vs Floating in the Post-2025 World

Interest rates are influenced by global and local economies. In 2025:

- Many economies are cooling inflation

- There is uncertainty around spending

- Markets are reacting to geopolitical shifts

- Central banks may adjust interest downward cautiously

This environment suggests:

✔ Floating rates may offer savings

✔ But they come with volatility risk

So the smarter choice is:

Floating for long-term loans if you can handle moderate fluctuations.

Fixed for short-term loans or if you value predictability.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/home-loan-pre-approved-pre-qualified/

Conclusion: Floating vs Fixed Rate — What Should You Do in 2025?

There is no one-size-fits-all answer because every borrower’s situation is different.

But here’s the practical takeaway:

Choose Fixed Rate If:

✔ You want predictable EMIs

✔ You have stable income

✔ You dislike uncertainty

✔ Your loan tenure is short

Choose Floating Rate If:

✔ You can tolerate moderate risk

✔ You expect rates to fall or stay stable

✔ You want lower overall long-term cost

✔ You may prepay or refinance later

Final Thought: Borrow Smart, Not Emotionally

Loans are not just numbers. They affect your life, emotions, family plans, investments, and financial freedom.

Choosing between fixed and floating rates is not just a technical decision—it’s a strategic financial choice.

If you make this choice with clarity, discipline, and planning, your home loan becomes a financial tool, not a burden.

Here’s to smart borrowing and a secure financial future in 2025 and beyond! 🎯

Leave a Reply to Zero Down Payment Car Loans — Truth & Hidden Charges (2026 Ultimate Guide) – Fundica Investments Cancel reply