A Comprehensive Guide to Smart Borrowing

In today’s financial landscape, loans play a vital role in achieving various life goals. Whether you’re looking to buy a home, finance a car, pay medical bills, grow a business, or tackle an unexpected expense—loans can get you there without the need to save for years.

That said, figuring out the right loan type can be a bit overwhelming, especially when you encounter terms like secured loans and unsecured loans. Each option has its own set of advantages and disadvantages, interest rates, and qualifying criteria. So, how do you figure out which one suits your situation?

In this guide, we’ll break things down in a straightforward way so you can make the best financial choice for yourself. By the time you finish reading, you’ll know:

- What secured loans are

- What unsecured loans are

- The key differences between the two

- The pros and cons of each option

- When to go for a secured or unsecured loan

- What you need to qualify and what documents to prepare

- How it affects your credit score

- Real-world examples

- Tips for selecting the right loan for your situation

If you want to create AI Ads you can visit: https://adscribe.online

Let’s dive into your borrowing journey!

📌 What is a Secured Loan?

A secured loan is a loan that requires you to put up an asset as collateral. If you can’t pay back the loan, the lender can take that asset. Because of this added security, interest rates for secured loans are typically lower.

Common examples of collateral:

- Property or a house

- Gold or jewelry

- Cars or other vehicles

- Fixed deposits

- Investments and bonds

- Business assets

Popular Types of Secured Loans:

Loan Type

Collateral

Home Loan

Property

Auto/Car Loan

Vehicle purchased

Gold Loan

Gold ornaments

Secured Business Loan

Business assets

Mortgage Loan

House/land

📍 Because lenders have security, they often approve larger loan amounts with longer repayment periods.

📌 What is an Unsecured Loan?

Unsecured loans don’t require collateral. Instead, the lender focuses on factors like:

- Your income

- Credit score

- Repayment history

- Job stability

Since there isn’t an asset backing it up, lenders assume more risk, so unsecured loans usually come with higher interest rates and shorter repayment terms.

Popular Types of Unsecured Loans:

Loan Type

Purpose

Personal Loan

Medical expenses, weddings, etc.

Credit Card Loans

Short-term borrowing via a credit line

Unsecured Business Loan

Business needs without collateral

Education Loan (sometimes)

Tuition and study expenses

📍 These are great for quick cash needs, emergencies, or when you don’t have anything to secure.

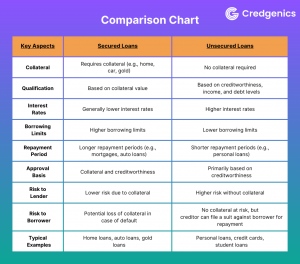

🔍 Secured Vs Unsecured Loans: Key Differences

Feature

Secured Loan

Unsecured Loan

Collateral Required

✔ Yes

❌ No

Interest Rate

Low

High

Loan Amount

Higher

Lower

Approval Time

Longer (valuation needed)

Fast

Risk to Borrower

Asset can be taken if default

Only affects credit score

Eligibility

Flexible

Strict

Repayment Tenure

Longer

Shorter

Feature

Secured Loan

Unsecured Loan

Collateral Required

✔ Yes

❌ No

Interest Rate

Low

High

Loan Amount

Higher

Lower

Approval Time

Longer (valuation needed)

Fast

Risk to Borrower

Asset can be taken if default

Only affects credit score

Eligibility

Flexible

Strict

Repayment Tenure

Longer

Shorter

📝 To put it simply:

- If you can provide collateral, go for a secured loan.

– If you’re looking for quick funds and have a solid credit record, choose an unsecured loan.

🎯 Advantages of Secured Loans

✔ Lower interest rates

✔ Higher loan amounts possible

✔ Longer repayment periods (up to 30 years)

✔ Easier approval even with moderate credit

✔ Great for long-term financial goals

Best for:

- Buying a home

- Financing a car

- Large business expenses

– Consolidating debt at lower rates

⚠️ Disadvantages of Secured Loans

❌ Risk of losing your collateral

❌ Longer processing time due to asset checks

❌ More paperwork involved

❌ Prepayment penalties can apply sometimes

📍 If you can’t keep up with payments, your asset is at risk.

🎯 Advantages of Unsecured Loans

✔ No collateral needed

✔ Fast approval (sometimes within 24 hours)

✔ Minimal paperwork

✔ Flexible usage—no restrictions on how you spend it

✔ Ideal for emergencies

Best for:

- Medical expenses

- Travel and weddings

- Short-term cash needs

– Personal financial crises

⚠️ Disadvantages of Unsecured Loans

❌ Higher interest rates

❌ Lower eligibility for loan amounts

❌ Shorter tenure can increase pressure on monthly payments

❌ Strict credit requirements

❌ Rejections can negatively impact your credit score

💸 Interest Rate Comparison

Loan Type

Average Interest Rate

Tenure

Home Loan (Secured)

8% – 12%

Up to 30 years

Car Loan (Secured)

9% – 14%

3–7 years

Personal Loan (Unsecured)

12% – 28%

1–7 years

Credit Card Loan (Unsecured)

24% – 42%

Up to 3 years

📍 More risk for lenders means higher interest for borrowers.

🧾 Credit Score Requirement

Loan Type

Minimum Credit Score

Secured Loan

600+ (flexible due to collateral)

Unsecured Loan

Usually 700+ required

📍 For unsecured loans, your credit report is crucial for getting approved.

📑 Documentation Requirements

Requirement

Secured Loan

Unsecured Loan

ID Proof

✔

✔

Address Proof

✔

✔

Income Proof

✔

✔

Credit Report

Optional

Mandatory

Collateral Documents

✔ Required

❌ Not Required

🧠 Which Loan Should You Go For?

Deciding between secured and unsecured loans boils down to your financial state, urgency, and how much risk you’re willing to take.

Go with a Secured Loan If:

✔ You own valuable assets

✔ You need a large loan

✔ You prefer lower monthly payments and interest

✔ You’re sure you can pay it back over time

✔ You’re looking to build long-term wealth (like in real estate)

Go with an Unsecured Loan If:

✔ You need cash fast for an emergency

✔ You don’t want to put up assets at risk

✔ You can pay it back quickly

✔ You have a strong credit score

✔ Your loan needs are small

🧩 Real-Life Examples

Let’s look at some examples for clarity:

🧍♂️ Scenario 1 — Buying a house

You need ₹50 Lakhs and can offer a property as collateral.

→ Best choice: Secured Home Loan

🧍♀️ Scenario 2 — Medical emergency

You urgently need ₹2 Lakhs.

→ Best choice: Unsecured Personal Loan

🧑💼 Scenario 3 — Expanding a business

You need a large sum of money and own business property.

→ Best choice: Secured Business Loan

👩🎓 Scenario 4 — College fees

You require a smaller amount quickly.

→ Best choice: Unsecured Education/Personal Loan

📉 Impact on Credit Score

Action

Effect on Credit Score

Timely EMI Payments

Improves score

Missed Payments

Score drops quickly

Loan Default

Hefty impact; legal actions may occur

High Credit Utilization

Raises risk rating

📍 Defaulting on a secured loan means losing the asset and damaging your credit score.

You can also read our other loans related blogs, please visit: https://loans.fundicainvestments.com/whats-a-loan-guide-to-smart-borrowing/

📍 Defaulting on an unsecured loan just hurts your credit and makes borrowing tougher later.

🔐 Risk Factor Comparison

Risk To Borrower

Secured Loan

Unsecured Loan

Losing asset

High

None

High-interest burden

Low

High

Rejection due to credit score

Low

High

📊 Cost of Borrowing: EMI Example

Let’s say you take a ₹5 Lakh loan for 3 years.

Loan Type

Interest Rate

Monthly EMI

Total Paid

Secured Loan

10%

₹16,134

₹5,80,824

Unsecured Loan

18%

₹18,086

₹6,51,096

📍 You’ll end up paying ₹70,000 more just because the loan is unsecured.

🛡️ Safety Tips for Smart Borrowing

✔ Compare multiple lenders before applying

✔ Keep a solid credit score

✔ Borrow only what you can realistically repay

✔ Review all terms before signing

✔ Be aware of processing fees, foreclosure charges, penalties

✔ Avoid applying for too many loans at once

✔ Have a repayment plan in place

📍 Remember: A loan is an obligation, not free money.

⭐ Secured vs Unsecured Loans: Summary Table

Category

Secured

Unsecured

Best for

Long-term goals

Short-term needs

Loan Amount

High

Limited

Interest Rate

Low

High

Collateral

Yes

No

Processing Speed

Slow

Fast

Eligibility

Easier

Tougher

Risk

Asset loss

Credit score loss

🧭 Final Thoughts: Which is Right for You?

There isn’t a universal answer to this. Each loan type serves a different purpose.

- If you’re making a significant purchase, want lower interest, and can provide collateral → Secured Loan is the way to go.

- If you need funds quickly without risking assets, and you can pay it back fast → Unsecured Loan makes more sense.

👉 The most important thing is to borrow thoughtfully, comprehend the terms, and make sure you can manage the EMIs within your budget.

📌 Frequently Asked Questions (FAQs)

1️⃣ Which loan offers lower interest rates?

→ Secured loans typically have lower rates since lenders have collateral to back them.

2️⃣ Can I switch an unsecured loan to a secured loan later?

→ Generally no, unless you go for refinancing or restructuring.

3️⃣ What happens if I don’t repay a secured loan?

→ The lender can take possession of the collateral.

4️⃣ Are personal loans unsecured?

→ Yes, most personal loans are indeed unsecured.

5️⃣ Which loan is better for beginners?

→ If your credit score is low → secured loan is better.

→ If you have a solid income and urgent needs → unsecured loan might be the choice.

✨ Final Thoughts

Loans can be powerful financial tools when handled wisely. Knowing the differences between secured and unsecured loans can help you find the right fit for your needs, repayment capacity, and risk tolerance.

Whether you’re looking to get your dream house or cope with unexpected expenses—making a well-informed choice today can safeguard your financial future tomorrow.

Always keep in mind:

Borrow smart, repay smart, and stay confident in your financial decisions!

Leave a Reply