In the financial world, the word “collateral” is one of the most important terms every borrower must understand. Whether you’re planning to take a home loan, business loan, car loan, or even a secured personal loan, collateral plays a key role in loan approval, loan amount, and interest rates.

Many people hear terms like secured loan, asset-based lending, or loan against property, but don’t fully understand what collateral actually means — and when lenders demand it.

This ultimate guide explains everything you need to know about collateral in a clear and human-friendly manner:

✔ What is Collateral?

✔ Why Do Lenders Need Collateral?

✔ What Qualifies as Collateral?

✔ When Do You Need Collateral for a Loan?

✔ Types of Loans That Require Collateral

✔ How Collateral Affects Loan Approval and Interest

✔ Risk Factors You Must Know

✔ Advantages & Disadvantages of Secured Loans

✔ What Happens if You Fail to Repay?

✔ Expert Tips to Choose the Right Collateral

✔ FAQs Borrowers Commonly Ask

By the end, you’ll be confident about how collateral works — and how to use it wisely while borrowing.

🏦 What Is Collateral?

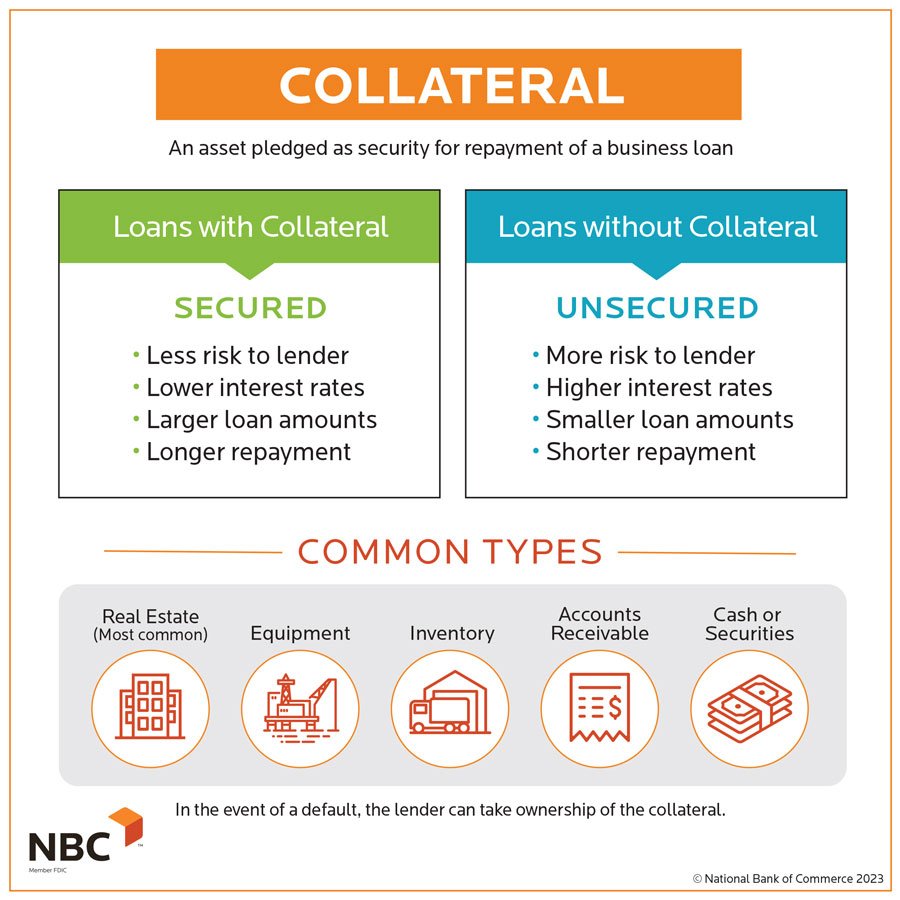

Collateral is a valuable asset that a borrower pledges to the lender as security for the loans.

If you are unable to repay the loan:

👉 The lender has the legal right to seize or sell the collateral to recover the loan amount.

Simple Example

You take a car loan, and the car itself becomes the collateral.

If you stop paying EMIs…

→ The bank can take the car back.

So, collateral protects lenders from financial loss, reducing their risk.

💡 Why Do Lenders Require Collateral?

Lenders always face risk when they give money. If a borrower stops paying, the lender must find a way to recover the funds.

Collateral provides assurance:

| Benefit for Lender | Benefit for Borrower |

|---|---|

| Reduced borrowing risk | Lower interest rates |

| Security in case of default | Higher loan approval chances |

| Faster loan recovery | Ability to borrow larger amounts |

| Encourages disciplined repayment | Longer repayment periods |

Collateral builds trust between borrowers and lenders — which is why secured loans are more borrower-friendly in terms of cost.

If you want to create AI Ads you can visit: https://adscribe.online

🏘 What Can Be Used as Collateral?

Almost all valuable financial and tangible assets can work as collateral. Here’s a complete list:

🔹 Property-Based Collateral

- Residential property

- Commercial property

- Land or plot

- Mortgaged house or building

🔹 Vehicle-Based Collateral

- Cars

- Motorcycles

- Trucks or commercial vehicles

- Boats or other transport vehicles

🔹 Financial Assets

- Fixed Deposits (FDs)

- Bonds

- Mutual funds (in some cases)

- Stock portfolio (pledged)

- Gold or Gold ornaments

- Insurance policies (with maturity value)

🔹 Business Assets

- Machinery & equipment

- Office inventory

- Accounts receivable (pending invoices)

- Warehouse stock

🔹 Other Valuable Assets

- Precious gems, jewelry

- Artwork, antiques (limited acceptance)

Key Point:

Collateral must be easy to value and easy to sell in case of default.

🧾 How Is Collateral Value Determined?

Lenders calculate Loan to Value (LTV) ratio:

LTV Ratio = (Loan Amount / Asset Value) × 100

Example:

- House value → ₹50,00,000 ($50,000)

- Bank LTV → 80%

- Max Loan → ₹40,00,000 ($40,000)

Banks never give full value as a loan because market prices may fluctuate.

🧍♂️ When Do You Need Collateral for a Loan?

Collateral is required when:

✔ You are borrowing a high loan amount

✔ You have a low credit score

✔ You have unstable income or no proof

✔ You are requesting a longer tenure

✔ You apply for a business or home loan

✔ The lender wants to reduce repayment risk

🏛 Types of Secured Loans That Require Collateral

| Loan Type | Collateral Used | Purpose |

|---|---|---|

| Home Loan | Property | Buying a house |

| Car Loan | Vehicle | Purchasing vehicle |

| Gold Loan | Gold items | Quick cash needs |

| Loan Against Property (LAP) | House/Land | Business expansion, education etc |

| Business Secured Loan | Equipment, property | Business funding |

| Education Loan | Property/FD | Higher education abroad |

| Secured Personal Loan | Financial assets | Debt consolidation, emergency use |

Fun fact:

Secured loans often have interest rates 30–60% lower than unsecured loans.

🆚 Secured Loan vs Unsecured Loan — Main Differences

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Requires Collateral | Yes | No |

| Loan Amount | Higher | Lower |

| Interest Rate | Low | High |

| Approval Time | Moderate | Fast |

| Risk for Borrower | Can lose asset | No asset loss |

| Loan Eligibility | Easier | Based on credit score |

| Example Loans | Home loan, car loan | Personal loan, credit card |

💸 How Collateral Affects Loan Approval & Interest Rate

Collateral influences:

| Factor | Impact of Strong Collateral |

|---|---|

| Approval Chances | Very high |

| Loan Amount | Higher amount approved |

| Interest Rate | Lower rate |

| Tenure | Longer repayment time |

| Negotiation Power | You can bargain for better terms |

Banks love low-risk, high-value assets — they reward borrowers accordingly.

⚠️ Risks of Using Collateral

Borrowing with collateral is safe only if you repay responsibly.

Key Risks:

- Losing your valuable asset

- Damage to property may reduce value

- Legal complications if loan terms are violated

- Higher penalty if collateral value drops

Pro tip:

Borrow only what you can comfortably repay.

🟢 Advantages of Collateral-Based Loans

| Benefit | Explanation |

|---|---|

| Low Interest Rates | Saves big on EMI payments |

| Higher Loan Amount | Suitable for large expenses |

| Better Approval Rate | Even with low credit |

| Flexible Repayment Terms | Longer EMIs reduce financial burden |

| Good for Business Growth | Helps start or expand operations |

🔴 Disadvantages of Collateral Loans

| Drawback | Concern |

|---|---|

| Asset Seizure Risk | If EMIs are missed |

| Valuation Challenges | Asset must be easily valued |

| Longer Processing Time | Legal checks & documentation |

| Limited Borrower Freedom | Asset cannot be sold/used freely |

Still, millions choose secured loans because cost savings are huge.

📌 Collateral Documentation Needed

A lender may require:

✔ ID Proof

✔ Asset ownership documents

✔ Proof of income

✔ Bank statements

✔ Asset valuation reports

✔ Insurance documents (for vehicles/property)

Any dispute or unclear ownership may cause loan rejection.

🤔 What Happens If You Cannot Repay the Loan?

If you default:

Step 1: Lender sends reminders & penalties

Step 2: Legal notices and restructuring options

Step 3: Collateral seizure and auction

Step 4: Remaining unpaid amount still collectible

You don’t become free just because the asset is taken — lenders can still pursue dues.

🧠 Smart Tips Before Using Collateral

- Evaluate your repayment ability

- Compare interest + processing fees

- Keep 3–6 months EMI backup

- Choose assets whose value doesn’t drop

- Avoid pledging your only home for risky investments

- Read the loan agreement carefully

- Take loan insurance if the bank offers

Never risk something emotionally valuable like ancestral property unless absolutely necessary.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/interest-rate-on-loans-are-calculated/

🔍 Real-Life Examples

| Scenario | Should You Use Collateral? | Reason |

|---|---|---|

| Expanding a successful business | Yes | Growth opportunity |

| Starting a risky new business | No | High failure risk |

| Paying medical bills | Yes (if emergency) | Quick relief |

| Buying luxury items | No | Waste of asset risk |

| Studying abroad | Depends | Consider ROI of career |

Use collateral only when the financial outcome outweighs the risk.

🌍 Collateral Requirements in Different Loan Industries

| Industry | Common Collateral Used |

|---|---|

| Banking | Property, deposits, vehicles |

| Microfinance | Land records, jewelry |

| Agriculture | Land, farm machinery |

| Education finance | Property, financial guarantees |

| Corporate loans | Business assets |

Most economies run on secured borrowing, especially in real estate and business expansion.

🧩 Frequently Asked Questions (FAQs)

❓ 1. Can I get a loan without collateral?

Yes, through unsecured loans, but interest will be higher.

❓ 2. Can I use someone else’s property as collateral?

Yes, but written consent and co-signing are required.

❓ 3. Can my collateral value change over time?

Yes. Property or vehicles may appreciate or depreciate, affecting loan terms.

❓ 4. Do I get my collateral back?

Yes — after full repayment, the lender removes the lien.

❓ 5. Which collateral is safest to pledge?

Assets with stable value: property, gold, fixed deposits.

🔑 Final Takeaway

Collateral helps people achieve goals that would otherwise be financially impossible — buying a home, starting a business, pursuing higher education, etc. Secured loans are often more affordable, more flexible, and easier to qualify for.

But…

📌 You must borrow responsibly because your asset is on the line.

✨ Conclusion

Collateral is a powerful financial tool that can:

✔ Boost your loan approval chances

✔ Help you secure lower interest rates

✔ Allow you to borrow higher amounts

✔ Support business growth and personal goals

However, keep in mind:

A secured loan is beneficial only when you can comfortably repay.

Smart borrowers always:

➡ Compare lenders

➡ Analyze repayment capability

➡ Protect their most important assets

Make decisions based on long-term financial stability, not short-term needs.

Leave a Reply