✨ Introduction

Picture this: You’ve finally decided to buy that dream bike, spruce up your home, or get funds for your business. You apply for a loan, feeling all excited… and then bam — the bank says no.

What gives?

Often, it’s not about your income — it’s your loan eligibility. Lenders aren’t just handing out cash willy-nilly. They need to see you can repay it back without a hitch.

The silver lining? You can boost your loan eligibility — and it’s probably easier than you think! This guide will take you through some smart, practical strategies to improve your chances of getting approved and qualifying for more cash.

Whether you’re after a personal loan, home loan, car loan, or even a business loan, these tips can help you navigate the process smoothly — plus, you might snag a better interest rate!

Let’s jump in.

🏦 What Does “Loan Eligibility” Mean?

Before diving into how to improve it, let’s clear up what loan eligibility really means.

Loan eligibility is basically how lenders evaluate:

✔ Your ability to pay back the loan

✔ How reliable you are as a borrower

✔ Your financial stability

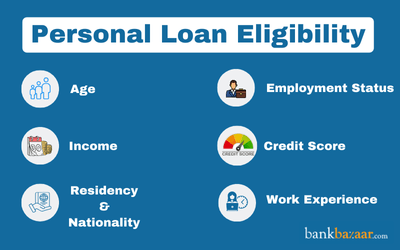

Banks consider a bunch of factors, such as:

Loan Eligibility Criteria | What Lenders Check

Income Level | Monthly salary, business profits, pay stability

Credit Score | Repayment history, loans, credit card usage

Existing Debts | EMIs you’re already paying

Employment Type | Government/private job, business owner, etc.

Age | Usually 21–65 is eligible

Location | Eligible cities, operational areas

Collateral (if it’s a secured loan) | Home, gold, vehicle, etc.

If you want to create AI Ads you can visit: https://adscribe.online

The better you score in these areas, the quicker you’ll get your loan approved.

⚡ Why Improving Your Loan Eligibility Matters

Upgrading your loan profile comes with several perks:

✨ Higher chances of approval

✨ Lower interest rates

✨ Bigger loan amounts

✨ Longer repayment options

✨ Quicker processing with less paperwork

✨ Leverage to negotiate with banks

In short — you get to borrow more, pay less, and breathe easier.

🚀 15 Effective Ways to Boost Your Loan Eligibility FAST

Now, let’s jump into the practical steps you can take right away.

1️⃣ Get Your Credit Score Above 750

Your credit score is often the first thing lenders check — it indicates how trustworthy you are with loans.

A score of 750 or higher means:

✔ Fast approvals

✔ Better interest rates

✔ Higher loan limits

Quick tips to raise your score:

Pay all EMIs and credit card bills before they’re due

Cut down on credit card balances

Avoid applying for several loans at once

Keep credit utilization below 30%

Fix any mistakes in your credit report

Checklist:

☑ Pay on time

☑ Lower outstanding debt

☑ Keep long-term credit accounts open

2️⃣ Keep Your Debt-to-Income (DTI) Ratio Low

Banks want to see how much of your income is already tied up in EMIs.

Ideal DTI ratio: ≤ 40%

For example:

If you earn ₹50,000/month → total EMIs shouldn’t go over ₹20,000

Ways to improve:

✔ Pay off small loans first

✔ Hold off on new credit card purchases before applying

✔ Refinance existing loans to lower rates

3️⃣ Opt for a Longer Loan Tenure

A longer tenure means lower EMIs, leading to better eligibility.

For instance:

A ₹10 Lakhs loan at 10%

5-year EMI → about ₹21,247

10-year EMI → about ₹13,215

With those lower EMIs, banks might approve larger loans.

⚠ But keep in mind — a longer tenure can mean paying more interest in the long run. Be smart about it.

4️⃣ Add a Co-Applicant or Co-Borrower

This is great for:

✔ Home loans

✔ Business loans

✔ Education loans

Good co-applicants could be:

Your spouse

Parents

Siblings with a solid income

This boosts:

✔ Combined income

✔ Strength in repayment

And that’s something lenders like!

5️⃣ Show Job Stability

Lenders prefer borrowers who’ve got:

✔ A stable job

✔ Consistent income

Try not to switch jobs too often, especially when you’re looking for a loan approval.

Being at your current job for at least 6–12 months can really help your chances.

If you’re self-employed?

✔ Show at least 2–3 years of consistent profit history

6️⃣ Pay Off Credit Card Balances

One big reason for loan rejections ⛔

➡ Maxed-out credit cards

If your utilization is over 50%, lenders might think you’re struggling financially.

To improve your score:

Pay the full amount, not just the minimum

Bring your utilization down to below 30%

Avoid asking for a credit limit increase right before a loan application

7️⃣ Ensure Your Documentation is Correct and Complete

Just one wrong document can delay or even derail your approvals.

Common documents you’ll need:

✔ ID proof

✔ Address proof

✔ Salary slips / Income Tax Returns

✔ Bank statements

✔ Business ownership records (if you’re self-employed)

Keep everything updated, clear, and accurate.

8️⃣ Choose a Loan Amount That Fits Your Income

Going for an unnecessarily high amount can increase your chances of rejection.

Instead:

Use online calculators to check your eligibility

Apply for smaller amounts over time

Work on improving your income profile first

9️⃣ Maintain a Healthy Bank Balance and Clean Transactions

Banks might review your statements from the past 6 months.

Negative or suspicious transactions can raise red flags.

Keep:

✔ No bounced checks

✔ A steady average balance

✔ Regular income deposits

🔟 Don’t Apply for Multiple Loans at Once

Each loan application leads to a hard inquiry from the lender.

➡ Your credit score dips a bit.

Too many rejections can hurt your credit profile 😬

It’s best to apply strategically with any pre-approved offers if you can.

1️⃣1️⃣ Add Extra Income Sources

Boost your income by including:

Rental income

Freelance work

Commission earnings

Regular bonuses

More income means better approval chances.

1️⃣2️⃣ Show Proof of Savings and Investments

Lenders appreciate it when borrowers manage their money well.

Keep records of:

✔ Fixed deposits

✔ Mutual funds

✔ Recurring deposits

✔ PPF / EPF

✔ Insurance policies

This demonstrates financial discipline and your ability to repay.

1️⃣3️⃣ Offer Collateral (If Possible)

If your income or credit isn’t the strongest, secured loans can be a smart choice.

Examples of collateral include:

Property

Gold

Vehicles

Fixed deposits

Benefits:

✔ Much higher eligibility

✔ Lower interest rates

1️⃣4️⃣ Consolidate Your Loans

If you’re juggling multiple small loans, consider rolling them into one.

This can reduce:

✔ The number of EMIs

✔ Hard inquiries

✔ The interest burden sometimes

A cleaner loan profile translates to higher approval.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/whats-a-loan-guide-to-smart-borrowing/

1️⃣5️⃣ Check & Fix Errors in Your Credit Report

Sometimes, loans are rejected due to:

❌ Incorrect late payments listed

❌ Wrong accounts

❌ Old loans still appearing as active

Check your report regularly and resolve any issues with the credit bureau.

📌 Bonus Tips for Quick Approval

Quick Boost Trick | Why It Works

Apply with your current bank | They already trust your financial habits

Try NBFCs if banks turn you down | They often have more flexible criteria

Look for pre-approved offers | No hassle with documentation

Stay in touch with your loan agent | Quick updates & error fixes

🧩 Real-Life Examples

📍Example 1 — Salaried Employee

Salary: ₹35,000

Current EMI: ₹15,000 → DTI too high

Fix: Prepay a smaller loan → Eligibility improved within weeks

📍Example 2 — Business Owner

Low credit score: 640

Regular cash income not recorded

Fix: Updated Income Tax Returns → Showed income → Loan approved

🧠 Expert Strategies for Different Loan Types

Loan Type | Best Way to Improve Eligibility

Personal Loan | Increase your score + lower DTI

Home Loan | Add a co-applicant + opt for a longer tenure

Car Loan | Make a larger down payment

Business Loan | Strong financial statements + collateral

Education Loan | Parent as co-borrower

❓Frequently Asked Questions (FAQ)

❓ How quickly can I improve my loan eligibility?

With focused effort — as fast as 30–60 days!

❓ Does checking my credit report affect my score?

No. Soft inquiries won’t impact your credit score.

❓ Can someone with a low salary still improve eligibility?

Absolutely — by:

✔ Adding a co-applicant

✔ Lowering EMIs

✔ Extending tenure

📝 Final Thoughts — Smart Borrowing for a Strong Future

Loans can be a great help — but only when planned wisely.

Here’s your winning checklist:

✔ Keep your credit score above 750

✔ Maintain a low EMI-to-income ratio

✔ Work on job & income stability

✔ Stay away from unnecessary debt

✔ Use co-applicants when it makes sense

You’re all set to apply for a loan with confidence.

📣 Conclusion — Your Financial Confidence Starts Now

Improving your loan eligibility doesn’t have to be a long process.

With just a few thoughtful changes, you can totally revamp your financial profile.

Just remember:

Loans aren’t the issue — poor borrowing habits are.

Leave a Reply