Getting loans today is easier than ever — whether it’s a home loan, car loan, business loan, or personal loan. But one thing that silently decides your loan approval, interest rate, and overall financial reputation is your Credit Score.

For many people, the term credit score sounds technical or confusing. But in reality, it is nothing more than a report card of how responsibly you manage your debt.

A good credit score can unlock lower interest rates, quick approvals, and higher loan amounts.

A bad credit score? It can lead to loan rejection, hefty interest, and financial stress.

In this Power-packed Ultimate Guide, you’ll learn:

🔹 What a credit score is and how it is calculated

🔹 Why lenders care about your score

🔹 How it impacts loans approval & interest rates

🔹 Credit score ranges and their meaning

🔹 How to build and maintain an excellent credit score

🔹 Mistakes that destroy your credit profile

🔹 Real examples, charts & expert-approved tips

By the end of this article, you’ll have the complete knowledge needed to become a smarter borrower and unlock better financial opportunities.

📌 What Is a Credit Score?

A credit score is a three-digit number that reflects your loan repayment behavior and overall creditworthiness.

It ranges between 300 to 900 (in India, evaluated by CIBIL, Experian, Equifax, CRIF).

Higher score = lower risk for lenders.

👉 It tells the lender:

✔ How you have handled your past credit

✔ Whether you are likely to repay the new loan on time

✔ Whether it’s safe to trust you with money

Think of it as your financial trust score.

🔍 How Is Credit Score Calculated?

Credit bureaus analyze your credit history and assign a score.

Here’s the breakdown:

| Factor | Weight | Details |

|---|---|---|

| Payment History | 35% | Timely EMI/credit card payments |

| Credit Utilization | 30% | Percentage of credit you use |

| Credit Age (History Length) | 15% | Longer history = better score |

| Credit Mix | 10% | Secured + unsecured loans |

| New Credit & Enquiries | 10% | Too many loans requests lower score |

📌 Your past behavior determines your future borrowing power.

If you want to create AI Ads you can visit: https://adscribe.online

📊 Credit Score Range & What It Means

| Credit Score | Status | Loan Outcome |

|---|---|---|

| 750 – 900 | Excellent | Very easy approval + lowest interest |

| 700 – 749 | Good | Approved with standard interest rates |

| 650 – 699 | Average | Higher interest rates + strict checks |

| 550 – 649 | Poor | Loan may be approved with very high rates |

| Below 550 | Very Poor | Mostly rejected |

📌 Above 750 = borrower’s golden zone

🏦 Why Lenders Consider Credit Score

Banks and financial institutions want to avoid risk.

A credit score answers key questions:

- Will the borrower pay back?

- Has the borrower defaulted before?

- Is this person able to handle multiple loans?

A higher score indicates:

✔ Strong financial discipline

✔ Lower risk of default

✔ Reliability in repaying debt

So, lenders feel confident lending to you.

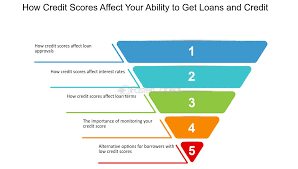

🧨 How Credit Score Affects Loan Approval

1️⃣ Loan Approval Speed

- High score → instant approval

- Low score → long waiting, document verification, guarantor requirement

2️⃣ Loan Eligibility

- Good score → higher loan amounts

- Bad score → lower limit or rejection

3️⃣ Loan Options

- You get access to premium loan products

- Low score restricts options to expensive loan offerings

💰 How Credit Score Affects Interest Rates

This is where the big impact lies!

| Credit Score | Approx Interest Rate (Example: Personal Loan) |

|---|---|

| 750+ | 9% – 12% |

| 700 – 749 | 12% – 16% |

| 650 – 699 | 16% – 22% |

| Below 650 | 22% – 30% (or rejection) |

📌 Lower interest = massive long-term savings

📍 Example to Understand the Difference

Loan Amount: ₹5,00,000

Tenure: 5 years

| Credit Score | Interest Rate | EMI (Approx) | Total Payment | Extra Interest Paid |

|---|---|---|---|---|

| 780 | 10% | ₹10,624 | ₹6,37,440 | ₹1,37,440 |

| 650 | 20% | ₹13,229 | ₹7,93,740 | ₹2,93,740 |

➡ A bad score costs you ₹1,56,300 extra on the same loan!

The higher the score, the more money you save.

📌 Credit Score and Different Loan Categories

🏠 Home Loan

- Scores 750+ get the lowest rates

- Low score may need higher down payment

🚗 Car Loan

- Interest increases significantly with lower scores

💳 Credit Cards

- Low score → lower limit + higher penalty fees + poor card features

👨🎓 Education Loan

- Co-borrower’s credit score is evaluated

🏢 Business Loan

- Score affects loans sanction amount and collateral requirements

📌 Across all loan types — credit score is a game changer.

🧐 Common Myths About Credit Score

| Myth | Truth |

|---|---|

| Checking your score reduces it | Only hard enquiries reduce score; soft checks do NOT |

| Salary affects credit score | No — only credit behavior matters |

| Closing old credit cards improves score | It can reduce score by shortening credit history |

| Paying minimum due is enough | No — interest pile-up hurts score |

🧩 Hidden Factors That Hurt Credit Score

- Too many unsecured loans

- Delay in EMI or credit card payments

- Using more than 30% of credit card limit

- Applying for multiple loans frequently

- Defaulting or settling a loan

- Not having any credit history at all

📌 Inactivity is also a negative indicator

💡 How to Improve Your Credit Score Quickly

✔ Pay EMIs & card bills before due date

✔ Maintain credit utilization below 30%

✔ Keep long-term credit accounts active

✔ Take a mix of secured + unsecured credit

✔ Avoid unnecessary loan applications

✔ Correct errors in your credit report

✔ Pre-pay loans when possible

✔ Use credit responsibly, not emotionally

📌 Small positive actions lead to massive improvements over time.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/interest-rate-on-loans-are-calculated/

🔎 How Long Does It Take to Improve Credit Score?

It depends on how low it currently is:

| Score Category | Time to Improve (Approx) |

|---|---|

| 700+ | 2–3 months |

| 600–700 | 6–9 months |

| Below 600 | 12–18 months with disciplined effort |

Credit rebuilding is slow but 100% achievable.

📝 Case Studies (Realistic Scenarios)

⭐ Case 1: Young Professional

- Uses credit card

- Pays full dues every month

- Score improves from 710 → 780

- Gets home loan at a reduced rate → saves ₹6 lakhs extra over tenure

🚩 Case 2: Frequent Loan Applicant

- Applies for multiple loans after job loss

- All reject → score drops from 690 → 620

- Approved only with very high interest

- Pays ₹70,000 extra because of poor score

📌 The difference? Smart borrowing vs desperate borrowing

🛡️ Credit Score & Financial Reputation

A high credit score:

✔ Boosts your financial image

✔ Makes lenders trust you

✔ Saves money for future goals

A bad score:

✘ Causes rejection

✘ Imposes penalties

✘ Blocks opportunities

Credit score is a digital reflection of your trustworthiness.

🪜 Why You Should Start Building Credit Early

- Longer credit history = higher score

- Early discipline ensures easy future financing (home/car)

- Builds financial maturity

Even a low-limit credit card can help start the journey.

🙋♂️ Frequently Asked Questions (FAQs)

Q1: Does checking my credit score reduce it?

✔ No — checking through authorized apps is a soft enquiry and does not impact score.

Q2: Can I get a loan with a credit score below 600?

✔ Possibly — but expect very high interest or collateral requirements.

Q3: How often should I check my credit report?

📌 At least once every 3 months to detect errors early.

Q4: If I pay off all loans, is my score automatically excellent?

❌ You still need active credit usage to show responsible behavior.

Q5: Does credit score affect co-applicant too?

✔ Yes — both applicants’ scores are evaluated.

🧠 Expert Smart Strategies

💡 If score is low → improve before applying → unlock better deals

💡 Negotiate rates using a high score

💡 Stay below 30% of credit card limit

💡 Avoid loans for short-term desires

📌 Credit score is your lifelong financial weapon.

🎯 Final Thoughts

Your credit score isn’t just a number — it’s a powerful financial identity that:

✔ Determines how easily you can access credit

✔ Decides how much interest you will pay

✔ Saves (or costs) you lakhs of rupees over a lifetime

✔ Reflects your credibility and money discipline

👉 Want the best loans?

👉 Want lower EMIs?

👉 Want financial freedom?

Then your credit score must become a priority.

Start building healthy financial habits today — your future self will thank you.

Because a great credit score = a great financial life! 💪✨

Leave a Reply