Introduction: The Interest Rate Choice That Most Borrowers Ignore

When you plan to take loans—whether it’s a home loan, personal loan, car loan, education loan, or business loan—you’ll be asked a question that many borrowers don’t think enough about:

“Do you want a fixed interest rate or a floating interest rate?”

Most people choose whatever the lender suggests, or whatever seems “normal,” or sometimes even whatever seems cheaper at the moment. But this one choice can impact:

- Your total loan cost

- Your monthly EMI

- Your loan tenure

- Your financial stability

- And ultimately, your peace of mind

Choosing the wrong interest rate type can make a loan unnecessarily expensive. Choosing the right one can save you lakhs over the years.

This guide breaks down everything you need to know—in a human-like, conversational way—so you can choose wisely without any confusion.

Let’s dive in.

What Are Interest Rates in Loans? A Simple Explanation

When you borrow money from a bank or lender, you pay them back with interest. The interest is the cost you pay for using their money.

But interest can be charged in two main ways:

- Fixed interest rate

- Floating (variable) interest rate

Both have different benefits, risks, and ideal situations.

To compare loans properly, you first need to understand these two types clearly.

If you want to create AI Ads you can visit: https://adscribe.online

What Is a Fixed Interest Rate? (In Simple Words)

A fixed interest rate is an interest rate that stays exactly the same throughout your loan tenure.

✔ Your EMI stays constant

✔ Your financial planning becomes easy

✔ Market rate changes have no impact on you

Simple Example:

You take a home loan at 8% fixed interest for 20 years.

Even if market rates go up to 10% or fall to 6%, you will still pay exactly 8%.

It’s like freezing your loan cost for the entire duration.

How Do Fixed Interest Rates Work?

- Lenders set a fixed rate based on current market conditions.

- Once you accept the loan, your EMI schedule is drawn for the entire tenure.

- You repay the same EMI every month until the end.

- You don’t benefit if rates fall.

- You aren’t affected if rates rise.

Fixed rates offer stability, predictability, and peace of mind.

They are especially useful when financial stability matters more than saving a few extra rupees.

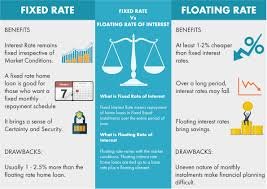

Benefits of Fixed Interest Rates

1. Predictable EMIs

Your EMI stays the same every month. This is ideal for people who love stability.

2. Easier Budgeting

You always know how much you need to pay.

3. Great for Long-Term Financial Planning

Perfect for salaried individuals or people with a stable monthly income.

4. Protection Against Rising Rates

If interest rates in the economy shoot up (as they often do), you remain unaffected.

5. Lower Stress

No surprises, no fluctuations, no sleepless nights over changing EMIs.

Drawbacks of Fixed Interest Rates

1. Higher Start Rate

Fixed rates are usually slightly higher than floating rates.

2. No Benefit from Rate Cuts

If market rates drop, you won’t save anything.

3. Higher Penalties for Prepayment

Some banks add foreclosure or prepayment charges for fixed-rate loans.

4. Fixed for Only a Certain Period (Sometimes)

Some lenders offer “semi-fixed” rates that stay fixed for only a few years.

What Is a Floating Interest Rate? (Explained Like a Human)

A floating interest rate, also called a variable rate, changes over time based on market factors.

This means your EMI can:

- Increase

- Decrease

- Or your tenure may change

depending on how interest rates move in the country.

Example:

You take a loan at 8% floating.

If RBI increases the repo rate, your lender may increase your interest to 8.5% or 9%.

If RBI lowers rates, your interest may fall to 7% or 7.5%.

Your EMI is not fixed.

How Do Floating Interest Rates Work?

Floating rates are linked to external benchmarks such as:

- RBI Repo Rate (most common)

- MCLR (Marginal Cost of Lending Rate)

- ECLIR / EBLR (External Benchmark Linked Rates)

When these rates change, your loan interest changes.

Example:

If the repo rate increases by 0.25%, your loan’s interest might also increase.

Floating rates adjust automatically as lenders revise their rates periodically (monthly or quarterly).

Benefits of Floating Interest Rates

1. Lower Initial Interest Rate

Floating rates start 0.3% to 1% cheaper than fixed rates.

2. You Benefit When Rates Drop

If the economy slows down or RBI cuts rates, your loan becomes cheaper.

3. Lower Long-Term Cost

Historically, floating loans have cost less over long tenures.

4. No Prepayment Penalties

Most lenders allow free prepayment or foreclosure for floating loans.

5. Ideal for Long-Term Loans

Over 10–20 years, floating loans often save more money.

Drawbacks of Floating Interest Rates

1. EMIs Can Increase Anytime

This creates uncertainty—especially for people with tight budgets.

2. Financial Planning Becomes Harder

You never know how EMIs will behave over time.

3. Can Become Expensive If Rates Rise

Sharp repo rate increases (like after inflation spikes) can raise EMIs significantly.

4. Stress and Risk

Floating rates require risk tolerance and financial buffers.

Fixed vs Floating Interest Rate: Side-by-Side Comparison

| Feature | Fixed Rate | Floating Rate |

|---|---|---|

| EMI | Constant | Changes over time |

| Market Impact | No effect | Highly affected |

| Starting Rate | Higher | Lower |

| Risk Level | Low | Medium–High |

| Long-term Savings | Lower | Usually higher |

| Prepayment Charges | Yes (often) | No |

| Stability | High | Low |

| Best for | Risk-averse borrowers | Smart, risk-tolerant borrowers |

When Should You Choose a Fixed Interest Rate?

Choose fixed when:

✔ You want peace of mind

✔ You prefer financial stability

✔ You’re a salaried employee with strict budgeting

✔ Interest rates are currently low

✔ You’re taking a short tenure loan (2–5 years)

✔ You dislike dealing with fluctuations

Good for:

- Personal loans

- Car loans

- Small business loans

- Short-term home loans

When Should You Choose a Floating Interest Rate?

Choose floating when:

✔ Rates are currently high (they may fall later)

✔ You’re comfortable with ups and downs

✔ You’re taking a long-term loan (10–30 years)

✔ You want to save more in the long run

✔ Your income is increasing over time

✔ You want to prepay without penalty

Ideal for:

- Home loans

- Education loans

- Long business loans

Real-Life Example: Fixed vs Floating

Scenario:

You take a ₹50 lakh loan for 20 years.

Fixed Rate: 8.5%

- EMI: ₹43,391

- Total interest: ₹54.14 lakh

Floating Rate: 8% (variable)

- EMI: ₹41,822

- Total interest: varies

- If the rate stays 8% → Interest: ₹50.78 lakh

- If rate increases to 9% → Interest: ₹64.45 lakh

- If rate decreases to 7% → Interest: ₹45.55 lakh

Floating can save or cost more—depending on rate movement.

How to Compare Loans and Pick the Right Interest Rate Type

Here is a step-by-step guide to comparing loans properly:

1. Compare the Starting Rate Difference

Typically:

- Fixed: 0.5% to 1% higher

- Floating: Lower, but can change

If the difference is huge (over 1%), floating may be better initially.

2. Check the Current Interest Rate Cycle

Ask yourself:

- Are rates currently rising?

- Are they at peak levels?

- Is the economy stable?

If rates are high → Choose floating (rates will likely fall).

If rates are low → Choose fixed (lock the rate).

3. Evaluate Your Risk Capacity

If rate increases will stress you out, choose fixed.

If you are okay with fluctuations, choose floating.

4. Look at Your Loan Tenure

- Short-tenure loans (1–5 years) → Fixed is better

- Long-tenure loans (10–30 years) → Floating saves more

5. Review Prepayment Rules

Floating loans usually allow:

✔ Zero prepayment charges

✔ Zero foreclosure charges

Fixed-rate loans often charge 2–4%.

6. Estimate the Worst-Case Scenario

Ask:

- If rates rise by 1% or 2%, can you still afford the EMI?

If not, fixed is safer.

7. Check Lender Policies

Different lenders handle floating rates differently.

Compare:

- Reset frequency (monthly/quarterly/annual)

- Benchmark used

- Spread (markup) on the benchmark

These affect your loan’s true cost.

Fixed vs Floating Interest Rate for Different Loan Types

Let’s look at which rate works best for different loans:

Home Loan

- Long tenure = floating is usually better

- If rates are very low = fixed may save money

Ideal Choice:

Floating (usually)

Personal Loan

- Short tenure

- Fixed EMIs are easier

Ideal Choice:

Fixed

Car Loan

- Mostly short-term

- EMI stability matters

Ideal Choice:

Fixed

Education Loan

- Rates fluctuate with repo rate

- Long tenure

Ideal Choice:

Floating

Business Loan

Depends on business cash flow stability.

- Stable income → Fixed

- Growing income → Floating

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/documents-needed-for-different-loans/

Frequently Asked Questions (FAQ)

1. Is floating interest rate always cheaper?

Not always. It can be cheaper in the long run if rates fall or stay stable.

2. Can I switch from fixed to floating?

Yes, lenders allow switching, but may charge fees.

3. Which is safer: fixed or floating?

Fixed rates are safer because they do not change.

4. Which is more popular in home loans?

Floating interest rates.

5. Is it possible to combine both rates?

Some lenders offer hybrid loans: partly fixed, partly floating.

Conclusion: Which Interest Rate Should You Choose?

The answer depends on your financial situation, risk tolerance, and market conditions.

Choose Fixed Rate if:

✔ You want stable EMIs

✔ You prefer low risk

✔ Rates are currently low

✔ Loan tenure is short

✔ You value peace of mind

Choose Floating Rate if:

✔ You want lower starting interest

✔ You are okay with EMI changes

✔ Rates are expected to fall

✔ Loan tenure is long

✔ You plan to prepay the loan

The best choice is the one that aligns with your financial comfort, long-term goals, and ability to handle risk.

Leave a Reply