Applying for loans—whether it’s for a house, car, education, business, or just personal needs—can be a bit daunting if you’re not ready. A common reason many people run into delays or even rejections is missing or incorrect paperwork.

The documents required can vary based on:

Your profession (salaried or self-employed)

The type of loans

Your financial background

The lender’s requirements

The loan amount

In this comprehensive guide, I’ll take you through each major loans category and list out the exact documents you need, along with why they’re important, how to prepare them, and savvy tips to speed up the approval process.

Whether you’re looking for a home loan, personal loan, car loan, business loan, education loan, or a secured loan, this article breaks it down in a straightforward way.

Let’s get started.

Why Lenders Ask for Documents

Before diving into specific requirements for each loan type, it’s good to understand why lenders need these documents in the first place.

Here’s what banks and financial institutions look into:

- Identity Verification

They want to make sure you are who you say you are to help prevent fraud.

- Address Verification

They need this for communication, risk assessment, and compliance with KYC (Know Your Customer) rules.

- Income Verification

This checks if you can comfortably repay the loan.

- Employment Stability

They need to see if your job situation is stable.

- Creditworthiness

This looks at your credit history and overall financial discipline.

- Asset Documentation

For loans requiring collateral, like a home or car.

- Purpose of Loan

Certain loans, like for a home or business, require proof of how you intend to use the funds.

Getting a grasp on these points helps you gather the right paperwork and avoid delays.

If you want to create AI Ads you can visit: https://adscribe.online

Common Documents Required for Most Loans

Most loans need these basic KYC documents:

- Identity Proof (Pick one)

PAN Card (required for most loans)

Aadhaar Card

Passport

Voter ID

Driving License

- Address Proof (Pick one)

Aadhaar Card

Passport

Utility bill (like electricity or water)

Rental agreement

Driving license

Property tax receipt

- Income Proof

This will differ for salaried versus self-employed applicants (I’ll explain that in each loan section below).

- Bank Statements

Generally, you’ll need 3 to 12 months of statements.

- Photographs

Recent passport-size photos.

These essentials are pretty standard across the board. Now, let’s break down each loan type in detail.

Documents Needed for Different Types of Loans

We’ll look into:

Personal Loan

Home Loan

Car / Auto Loan

Business Loan

Education Loan

Gold Loan

Loan Against Property

Credit Card Loan / Overdraft Loan

Consumer Durable Loan

Debt Consolidation Loan

Each section will include:

Documents for Salaried Applicants

Documents for Self-Employed Applicants

Extra Documents

Insights

Tips to avoid rejection

Let’s go through them one by one.

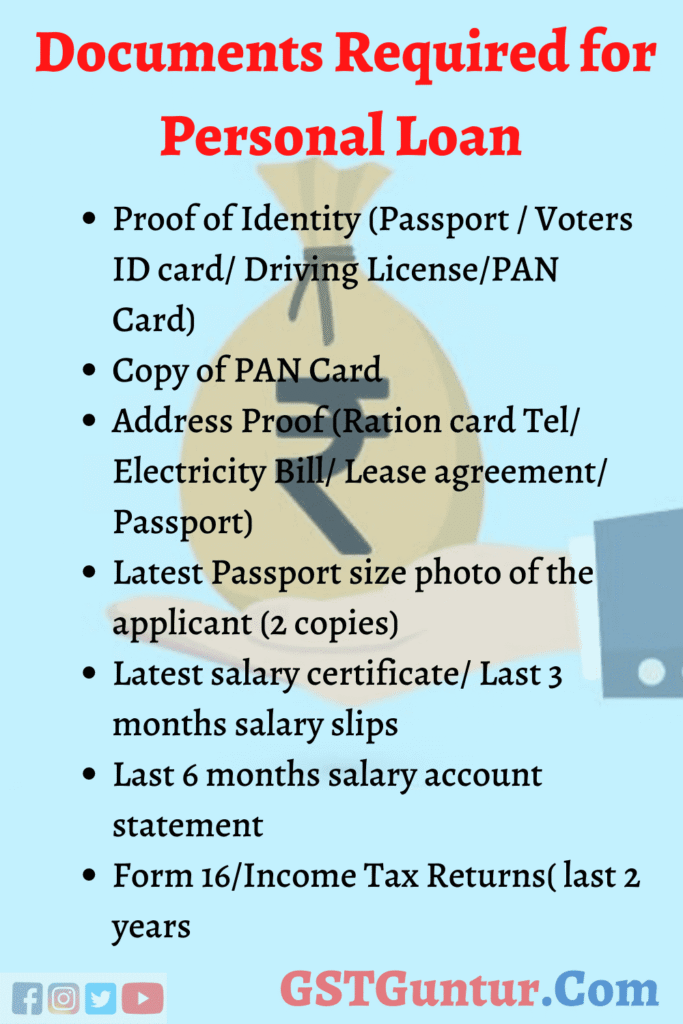

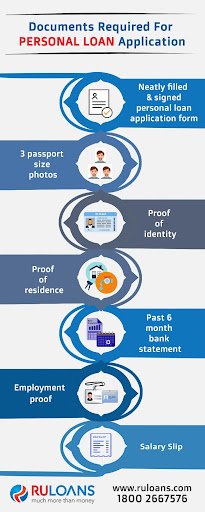

- Documents Required for a Personal Loan

(It’s one of the easiest loans to apply for, but you’ll need solid income and credit proof.)

A. For Salaried Individuals

Income Proof

Last 3–6 months’ salary slips

Form 16

Latest ITR (optional but can boost your approval chances)

Employment Proof

Employee ID card

Employment verification letter (if asked)

Offer letter / appointment letter

HR contact info

Bank Statements

Last 3–6 months (for the account where your salary goes)

KYC Documents

PAN

Aadhaar

Passport / Voter ID

B. For Self-Employed Individuals

Income Proof

Last 2–3 years’ Income Tax Returns (ITR)

Profit & Loss statements

Balance sheets

Business registration docs

Bank Statements

6–12 months from your business account

Business Proof

GST certificate

Shop/establishment certificate

Partnership deed / MOA / AOA

Professional license (if required)

Additional Documents

Credit report (the lender will pull this)

Rental agreement / utility bill

Recent photograph

Tips for Faster Approval

Keep your credit score above 700

Try not to apply for multiple loans at once

Stay in your job for at least 6 months

Make sure your salary matches your deposits

- Documents Required for a Home Loan

(Home loans typically need the most paperwork due to the larger loan amounts.)

A. For Salaried Individuals

Income Documents

Last 6 months’ salary slips

Form 16 (for the last 2 years)

Last 2–3 years’ ITR

Salary account statements for 6–12 months

Employment Documents

HR verification letter

Proof of employment continuity

Contract/offer letter

B. For Self-Employed Individuals

Income Documents

Last 3 years’ ITR filings

Audited balance sheets

Profit & loss statements

GST returns

Last 12 months’ bank statements

Business Proof

Business registration certificate

MSME certificate

Partnership deed / MOA / AOA

Trade license

C. Property Documents (Very Important)

Banks want to verify the property before agreeing to the loan:

Sale agreement

Title deed

Builder-buyer agreement

Allotment letter

Occupancy certificate

Encumbrance certificate (EC)

Construction plan approval

NOC from society/builder

Payment receipts to the builder

D. KYC Documents

PAN

Aadhaar

Passport (optional)

Tips for Hassle-Free Home Loan Approval

Keep a strong credit score (at least 750)

Have complete and clear property documents

Avoid cash transactions

Maintain good banking habits

Pay down existing loans before applying

- Documents Required for a Car Loan

Car loans are easier than home loans but still need some financial verification.

A. Salaried Individuals

Salary slips (3–6 months)

Form 16

Bank statements

PAN + Aadhaar

Address proof

Recent passport-size photos

Employment ID

B. Self-Employed Individuals

ITR (2–3 years)

Audited financials

Business proof

Bank statements (12 months)

C. Vehicle-Related Documents

Vehicle quotation

Proforma invoice

Vehicle registration details (after purchase)

Tips

A better credit score can help you secure a lower interest rate

Opt for a trustworthy dealership

Check for NOC if it’s a used vehicle purchase

- Documents Required for a Business Loan

Business loans need detailed financial and business documents.

A. For Proprietors / Self-Employed Individuals

Identity & Address Proof

PAN

Aadhaar

Passport / Driving License

Business Proof

GST registration

Shop establishment certificate

Trade license

Partnership deed / MOA / AOA

Financial Documents

Last 2–3 years’ ITR

Bank statements (12 months)

Profit & Loss statement

Balance sheet

Cash flow statements

B. For Private Limited Companies

Corporate Documents

Certificate of incorporation

Board resolution for loan approval

Memorandum & Articles of Association

Shareholding pattern

Financial Records

Audited financials

GST filings

ITR

Bank statements

C. Additional Documents

Business plan (for startups)

Collateral papers (if it’s a secured loan)

Credit history

- Documents Required for an Education Loan

Education loans need both student and parent documents.

A. Student Documents

Identity proof

Address proof

Recent passport-size photos

Academic records

Entrance exam results

Admission letter

Fee structure from the university

B. Parent/Guardian Documents

PAN / Aadhaar

Salary slips (for salaried)

ITR (for self-employed)

Bank statements

Property documents (for collateral-based education loans)

C. Course-Related Documents

University accreditation certificate

Visa documents (for studying abroad)

Tips

Make sure the admission letter is original

Keep the fee structure updated

The credit score of your co-applicant matters a lot

- Documents Required for a Gold Loan

Gold loans are among the simplest loans to obtain.

Generally, you just need:

Aadhaar

PAN

1 passport-size photo

Gold purity check (the lender will do this onsite)

No need for income proof.

No credit score is needed.

- Documents Required for Loan Against Property (LAP)

This requires nearly as much paperwork as home loans.

KYC

PAN

Aadhaar

Income Proof

Salary slips / ITR / business financials

Property Documents

Title deed

Sale deed

Property tax receipts

Encumbrance certificate

NOC from society

Valuation Report

Provided by the bank surveyor

- Documents Needed for Credit Card Loan / Pre-Approved Loan

These generally require minimal documentation since the bank already has your information.

Usually required:

PAN

Aadhaar

Recent bank statement

Signed loan consent form

Sometimes, you might not need any extra documents at all.

- Documents Needed for Consumer Durable Loan

Loans for gadgets, electronics, and appliances.

Required Documents

PAN

Aadhaar

Salary slips / bank statements

Product invoice

Store bill

- Documents Needed for Debt Consolidation Loan

Documents Needed

KYC

Income proof

List of existing loans

Loan account statements

Bank statements

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/common-loans-myths-and-truth-behind/

How to Prepare Your Documents for Faster Loan Approval

Check out these steps:

✔ Step 1: Keep Soft Copies Ready

Scan all your documents in PDF format.

✔ Step 2: Check Expiry Dates

Ensure your ID proofs are valid.

✔ Step 3: Make Sure Bank Statements Are Clear

No overwriting or missing pages.

✔ Step 4: Linking PAN & Aadhaar

Verify that they are linked, as many lenders will want this for e-KYC.

✔ Step 5: Maintain Income Consistency

Frequent job changes can slow down approvals.

✔ Step 6: Keep Your Credit Score in Check

Pay bills on time, avoid high credit utilization, and don’t submit multiple loan applications at once.

✔ Step 7: Provide Consistent Information

Any mismatch in address or salary info can lead to rejection.

Why Loan Applications Get Rejected (Avoid These Document Mistakes)

Here are common reasons related to documents that lead to rejections:

Providing fake or altered documents

Incomplete application forms

Mismatch between PAN/Aadhaar details

Salary statements that don’t match with bank deposits

Missing ITR for self-employed applicants

Poor-quality scanned copies

Unclear property titles

Signature mismatches

Steering clear of these can help make your approval process smoother.

Frequently Asked Questions (FAQ)

- Can I get a loan without income proof?

Yes—gold loans, some secured loans, and certain NBFC personal loans might not require income proof.

- Are PAN and Aadhaar required?

For most loans, especially under KYC norms, yes.

- Do lenders verify documents?

Absolutely. Verification can include:

Physical checks (for larger loans)

Employment confirmations

Checking your bank balance and transaction history

- Can I use digital copies?

Most lenders are okay with scanned PDFs.

- Why are property documents so crucial?

Lenders need to confirm ownership, legality, and value.

Conclusion

Whether you’re going for a personal loan, home loan, car loan, business loan, or education loan, your documents are key to how quickly your loan gets approved—or if it gets approved at all.

The secret to a smooth loan application process is pretty straightforward:

Stay organized

Keep your financial records tidy

Update your KYC regularly

Provide accurate info

Keep your credit score healthy

When your paperwork is in order, verified, and submitted correctly, it makes the lender’s job easier—and boosts your chances for a quick approval.

Leave a Reply