Introduction: The Big Decision Most Car Buyers Face

Buying a car used to be simple — save, buy, own. But today, with so many financial options available, buying a car isn’t as straightforward anymore. Two financing paths often stand in front of modern buyers:

- Car Loan — You borrow money to own the car.

- Car Lease — You pay to use the car for a fixed period (like rent).

Both options have their advantages, but the pressing question for most people is this:

Which option actually saves money — a car loan or a car lease?

This guide will help you answer that question clearly.

Whether you’re buying your first car, upgrading your ride, or deciding between long-term ownership vs short-term use, this article breaks down:

✅ What exactly a car loan and car lease are

✅ How each one works

✅ The true cost of each over time

✅ Pros and cons of both

✅ Real money examples

✅ Mistakes to avoid

✅ When one clearly beats the other

By the end, you’ll understand not just the numbers, but how each choice impacts your lifestyle, savings, and peace of mind.

Chapter 1: What Is a Car Loan? (Plain and Simple)

A car loan is a type of loan where a bank, NBFC, credit union, or online lender gives you money to buy a car. You repay that money in monthly EMIs (Equated Monthly Installments), usually with interest.

How a Car Loan Works

- You choose a car and decide how much you want to borrow

- You apply for a loan from a lender

- The lender evaluates your income, credit score, debt obligations, etc.

- If approved, the loan amount is disbursed

- You pay back the loan in EMIs over an agreed period

- Once fully paid, the car legitimately belongs to you

In a nutshell:

Buy now, pay later — and the car is yours.

If you want to create AI Ads you can visit: https://adscribe.online

Chapter 2: What Is a Car Lease? (Breaking It Down)

A car lease is more like a long-term rental arrangement.

Instead of owning the car, you pay a monthly fee to use it for a specific period (usually 2–5 years). After the lease ends, you return the car or sometimes have the option to buy it.

In leasing:

- You don’t own the car (unless the lease has a purchase option)

- You pay for using the car, not owning it

- The value or depreciation risk stays with the leasing company

In short:

Lease = rent a car for a period, then return it.

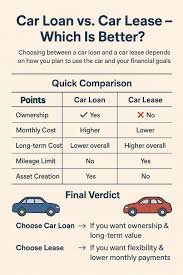

Chapter 3: Car Loan vs Car Lease — Key Differences at a Glance

To build a foundation, let’s start with a quick comparison:

| Feature | Car Loan | Car Lease |

|---|---|---|

| Ownership | You own the car | You don’t own the car |

| Upfront Cost | Moderate (down payment) | Minimal (may be low or zero) |

| Monthly Payment | Based on loan + interest | Based on depreciation value + fees |

| Maintenance Responsibility | Owner (you) | Depends on lease terms |

| No. of Years | Typically 3–7 | Typically 2–5 |

| Mileage Restrictions | No | Often Yes |

| Customization | Full | Usually Not |

| Resale Value | You get it | Not applicable (you return) |

| Tax Benefits | Yes (in some cases) | Yes (for business leases) |

Chapter 4: How Car Loan Payments Are Calculated (EMI Theory)

A car loan EMI depends on:

✔ Loan amount

✔ Interest rate

✔ Loan tenure

✔ Down payment

EMI Formula Explained

While lenders use a standard formula, the simple logic is:

- Higher loan amount → higher EMI

- Higher interest rate → higher EMI

- Longer tenure → lower monthly EMI, but higher overall interest

Here’s a quick example:

Car price: ₹10 lakh

Down payment: ₹2 lakh

Loan amount: ₹8 lakh

Interest rate: 10% p.a.

Tenure: 5 years

Your EMI might be roughly ₹17,000–₹18,000 per month.

The total cost of the car loan = Sum of all EMIs + down payment

Chapter 5: How Car Lease Payments Are Calculated

Lease payments are based on:

- Capitalized cost (Car value)

- Residual value (Estimated value at lease end)

- Depreciation amount

- Lease interest (sometimes called money factor)

- Lease term (duration)

In a lease:

- You pay for the depreciation of the car during the lease term

- Not the full value of the car

This often makes monthly lease payments lower than loan EMIs for the same car.

For example:

Car price: ₹10 lakh

Lease term: 3 years

Residual value after 3 years: ₹6 lakh

Depreciation cost: ₹4 lakh + interest

Your monthly payment might be based on ₹4 lakh spread over lease months — often lower than a loan EMI.

Chapter 6: Detailed Pros & Cons of Car Loans

Pros of a Car Loan

✔ You Own the Car

Once the loan is repaid, the car is 100% yours.

✔ No Mileage Restrictions

Drive as much as you want without penalties.

✔ Customize Freely

You can modify or accessorize your car.

✔ Helps Build Equity

You can sell the car later to recover some value.

✔ Potential Tax Benefits

In some countries, if used for business, interest payments may be deductible.

Cons of a Car Loan

✘ Higher Monthly Payments

EMIs are usually higher than lease payments for the same car.

✘ Long-Term Financial Burden

You are responsible for the loan even if you sell the car.

✘ Maintenance Responsibility

You have to maintain and repair the car at your cost.

✘ Depreciation Risk

Cars lose value fast — especially new ones.

Chapter 7: Detailed Pros & Cons of Car Lease

Pros of Car Lease

✔ Lower Monthly Payments

You only pay for depreciation + fees — not the full car value.

✔ Regularly Upgrade to New Cars

When lease term ends, you can choose another new car.

✔ Less Maintenance Hassle

Many leases include free maintenance or warranty coverage.

✔ Predictable Costs

No surprises, as long as you stick to agreed rules.

Cons of Car Lease

✘ You Don’t Own the Car

At the end of lease, you must return it unless there’s a buy-out option.

✘ Mileage Limits

Leases often have annual mileage caps — exceeding them costs extra.

✘ Customization Limits

No modifications allowed without penalties.

✘ Long-Term Cost Can Be Higher

If you lease repeatedly for decades, total cost can exceed ownership.

Chapter 8: Real-Life Cost Comparison — Loan vs Lease

To answer “Which saves money?” we must look at real numbers.

Let’s compare a 5-year example:

Scenario A: Car Loan

- Car price: ₹10 lakh

- Down payment: ₹2 lakh

- Loan amount: ₹8 lakh

- Interest rate: 10% p.a.

- Tenure: 5 years

Monthly EMI: ~₹17,000

Total Payments: ~₹10.2 lakh

Residual car value after 5 years: ~₹4–5 lakh (you can sell)

Scenario B: Car Lease

- Car price: ₹10 lakh

- Lease term: 5 years

- Residual value after 5 years: ₹5 lakh

Monthly lease payment: ~₹12,000–₹13,000

Total Lease Payments: ~₹7.2–₹7.8 lakh

No resale value (unless you buy at end)

Which Saves Money on Paper?

At first glance, leasing seems cheaper:

- Loan cost: ~₹10.2 lakh

- Lease cost: ~₹7.6 lakh

But this ignores the resale value of the car you own in the loan scenario.

If you sell the car after 5 years for ~₹4 lakh:

Net cost of car loan option:

₹10.2 lakh − ₹4 lakh = ₹6.2 lakh

Now the numbers look closer:

| Option | Total Cost (5 years) |

|---|---|

| Car Loan | ~₹6.2 lakh (net) |

| Car Lease | ~₹7.6 lakh |

In this scenario, the car loan actually saves money long-term — especially if the resale value remains strong.

Chapter 9: Hidden Costs You Need to Consider

Hidden Costs of Car Loans

- Processing fee

- Loan foreclosure charges

- Higher interest if credit score is low

- Insurance cost

- Maintenance cost (fully yours)

Hidden Costs of Car Leases

- Mileage penalties

- Wear-and-tear charges

- Early termination fees

- Lease documentation & service charges

Looking only at monthly payments without considering these can mislead you.

Chapter 10: 2025 Market Context — Rates, Trends & Economic Reality

Understanding the 2025 context helps you decide wisely.

Interest Rates in 2025

Post-pandemic economies have seen:

- Interest rate volatility

- Inflation pressures

- Central bank adjustments

If interest rates remain high, lease payments may stay lower relative to loan EMIs.

If rates fall, loan EMIs (especially floating-rate loans) become more affordable.

Car Depreciation Trends

Cars depreciate fast:

- New car loses 20–30% value in the first year

- 50%+ within 5 years

This depreciation helps lease cost calculations but suggests ownership can be cheaper if resale value remains reasonable.

Electric Vehicle (EV) Trends

EVs are changing the game:

- Lease options are more flexible for EVs

- Technology evolves fast — leasing lets you upgrade frequently

- Battery depreciation and warranty life are considerations

All these factors influence the loan vs lease decision in 2025.

Chapter 11: Tax Implications — Loan vs Lease

Car Loan

In some cases (especially business use), you may be eligible for:

✔ Depreciation deduction

✔ Interest deduction

✔ Business expense claims

This reduces net cost.

Car Lease

Leases also have tax benefits:

✔ Lease payments often fully deductible as business expense

✔ No depreciation worries

Tax laws vary by country and purpose — always consult an accountant for personalised advice.

Chapter 12: Loan vs Lease — Which Is Better by Use Case?

Case 1: You Commute Daily 50–100 km

✔ Loan — better if you high mileage (no penalties)

✔ Lease — can be costly if mileage caps are low

Winner: Loan

Case 2: You Want the Latest Car Every Few Years

✔ Loan — resale hassles

✔ Lease — easy upgrades

Winner: Lease

Case 3: You Want Low Monthly Outflow

✔ Loan vs lease — lease usually lower

Winner: Lease (initial monthly cost)

Case 4: You Plan to Keep the Car Long-Term

✔ Ownership makes more sense

✔ Lease becomes repetitive cost

Winner: Loan

Case 5: You Use the Car for Business

Both have tax benefits — depending on local tax laws.

Winner: Depends on tax rules and your income structure

Chapter 13: Emotional & Psychological Factors That Matter

Sometimes people choose emotionally:

- “I want to own my car”

- “I love customizing my ride”

- “I don’t like restrictions”

- “I want a predictable monthly cost”

Your personality, risk tolerance, and lifestyle matter as much as the numbers.

Ownership brings pride, but leasing brings convenience.

Chapter 14: Should You Refinance Instead of Lease?

Refinancing means replacing your loan with a better one.

When does refinancing save money?

✔ Interest rates drop

✔ Your credit score improves

✔ Better loan terms become available

Refinancing can significantly lower your EMI and total cost — sometimes better than a lease.

Chapter 15: Mistakes to Avoid in Loan vs Lease Decisions

❌ Choosing only based on monthly payment

Never ignore total cost.

❌ Ignoring hidden fees

Extra charges add up quickly.

❌ Ignoring resale value

Ownership offers a rebound in cost.

❌ Not reading lease fine print

Mileage caps and termination fees hurt.

❌ Not comparing deals

Always shop around for the best loan or lease offer.

Chapter 16: Step-By-Step Decision Guide (Practical for 2025)

Here’s a simple checklist:

Step 1: Determine Your Purpose

- Daily commute

- Long road trips

- Business use

- Family car

Step 2: Decide Your Budget

- Monthly limit

- Down payment ability

- Long-term saving plan

Step 3: Compare Car Loan Offers

- Interest rate

- Loan tenure

- Processing fees

- Total cost

Step 4: Compare Lease Offers

- Mileage limits

- Lease duration

- Down payment

- Penalties

Step 5: Calculate 5-Year Cost Scenarios

Include:

- Loan EMIs + maintenance + resale

- Lease payments + penalties

Step 6: Consider Tax Implications

Get help from a tax advisor.

Step 7: Choose Based on Total Cost + Emotional Fit

Chapter 17: Frequently Asked Questions (FAQ)

1. Is leasing always cheaper than buying?

Not always. Monthly payments are often lower, but total cost over long term can be higher.

2. Can I end a lease early?

Yes, but early termination charges usually apply.

3. Can I sell a car I bought with a loan?

Yes — but the loan must be fully repaid first.

4. Which is better for short-term needs?

Lease is usually cheaper for short terms (2–3 years).

5. Which is better for high mileage usage?

Car loan (ownership) has no mileage restriction.

Chapter 18: Case Study — Real Money Comparison

To make this more practical, here’s a real comparison:

Scenario

Car price: ₹15 lakh

Loan rate: 9%

Lease term: 3 years

Residual value after 3 years: ₹8 lakh

Loan Option

Down payment: ₹3 lakh

Loan: ₹12 lakh

EMI (5 yrs): ~₹24,600

Total outflow (5 yrs): ~₹14.8 lakh

Resale value after 5 yrs: ₹6.5 lakh

Net cost: ~₹8.3 lakh

Lease Option

Monthly lease: ₹21,000

Lease total cost (3 yrs): ~₹7.6 lakh

No resale value

In this example:

- Loan may cost more monthly but ends up cheaper after resale value

- Lease is cheaper upfront but has no asset value

Chapter 19: Real Borrower Experiences (Quotes)

Priya, 34, Engineer

“I leased my car because I wanted upgrades every 3 years. It was cheaper monthly and I avoided resale hassles.”

Amit, 40, Business Owner

“I chose a loan because I drive long distances and I wanted to own my car. After 7 years, it’s a valuable asset.”

Conclusion: So, Which One Actually Saves Money in 2025?

If you’re asking, “Car loan vs car lease — which one saves money?”, here’s the practical answer:

✔ For Long-Term Savings & Ownership

Car Loan usually saves more money because you gain resale value and equity.

✔ For Lower Monthly Payments & Upgrade Flexibility

Car Lease can be smarter if you value flexibility and predictable cash flow.

✔ For High Mileage Users

Car Loan wins — no penalties.

✔ For Short-Term Users or Businesses

Leasing can be cost-effective if tax benefits apply.

Final Words: Your Choice Is Personal, But Your Calculation Must Be Rational

Choosing between a car loan and a car lease shouldn’t be emotional — it should be financial and personal.

Ask yourself:

- How long will I keep the car?

- How much do I drive?

- What is my monthly budget?

- Do I want upgrades every few years?

- Can I handle maintenance costs?

Answering these questions, along with the cost comparisons in this guide, will help you make the best decision for your money and your life in 2025.

Leave a Reply