Car loans make vehicle ownership easy, but many borrowers don’t realize that taking a car loan is not a one-time decision. Just because you accepted a loan at a certain interest rate or tenure doesn’t mean you’re stuck with it forever.

This is where car loan refinancing comes in.

Car loan refinancing allows you to replace your existing car loan with a new one—usually at a lower interest rate, better tenure, or improved terms. If done at the right time and for the right reasons, refinancing can save you thousands of rupees (or dollars) over the life of your loan.

However, refinancing is not always beneficial. In some cases, it may even increase your overall cost if you’re not careful.

In this detailed guide, we’ll break down what car loan refinancing is, when it makes sense, why people do it, how it works step by step, and mistakes to avoid—so you can make a smart, well-informed decision.

Table of Contents

- What Is Car Loan Refinancing?

- How Car Loan Refinancing Works

- Why People Refinance Their Car Loan

- When Is the Right Time to Refinance a Car Loan?

- When You Should NOT Refinance Your Car Loan

- Key Benefits of Car Loan Refinancing

- Potential Drawbacks & Risks

- Car Loan Refinancing vs Loan Restructuring

- Step-by-Step Process to Refinance a Car Loan

- Eligibility Criteria for Car Loan Refinancing

- Documents Required for Refinancing

- How Much Can You Save by Refinancing?

- Impact of Refinancing on Credit Score

- Refinancing with the Same Lender vs New Lender

- Common Mistakes to Avoid While Refinancing

- Frequently Asked Questions (FAQs)

- Final Verdict: Should You Refinance Your Car Loan?

1. What Is Car Loan Refinancing?

Car loan refinancing is the process of paying off your existing car loan using a new loan, usually from another lender (or sometimes the same lender), under better terms.

In simple words:

You replace your old car loan with a new one that suits your current financial situation better.

Example:

- Old loan interest rate: 11.5%

- New loan interest rate: 8.5%

- Outstanding loan amount: ₹6,00,000

- Remaining tenure: 4 years

By refinancing, you may:

- Reduce your monthly EMI

- Save on total interest

- Adjust your loan tenure

2. How Car Loan Refinancing Works

Car loan refinancing follows a straightforward process:

- You apply for a new car loan (refinance loan).

- The new lender evaluates your credit score, income, vehicle value, and repayment history.

- Once approved, the new lender pays off your existing lender directly.

- Your old loan gets closed.

- You start paying EMIs to the new lender under revised terms.

The car remains the same—only the loan changes.

If you want to create AI Ads you can visit: https://adscribe.online

3. Why People Refinance Their Car Loan

There are several valid reasons borrowers choose to refinance their car loan.

1. To Get a Lower Interest Rate

Interest rates change over time. If market rates drop or your credit profile improves, refinancing can help you secure a cheaper loan.

2. To Reduce Monthly EMI

Lower EMIs can free up cash for:

- Household expenses

- Investments

- Emergency savings

3. To Shorten Loan Tenure

Some borrowers refinance to:

- Keep EMI similar

- Pay off the loan faster

- Reduce overall interest cost

4. Improved Credit Score

If your credit score has improved since you took the original loan, lenders may offer better terms.

5. Switching from NBFC to Bank

Banks often offer:

- Lower interest rates

- Better transparency

- Lower foreclosure charges

4. When Is the Right Time to Refinance a Car Loan?

Timing is critical when it comes to refinancing.

✅ Ideal Situations to Refinance

1. Interest Rates Have Dropped

If current car loan rates are 1–2% lower than your existing rate, refinancing may be worthwhile.

2. Your Credit Score Has Improved

A higher credit score (750+) unlocks:

- Lower interest rates

- Better negotiation power

3. You Are Early in Your Loan Tenure

Refinancing works best within the first 50% of the loan tenure, when interest outgo is higher.

4. Your Income Has Stabilized

A stable or higher income may allow:

- Shorter tenure

- Faster loan repayment

5. Existing EMI Is Straining Your Budget

Refinancing can reduce EMI and ease cash flow.

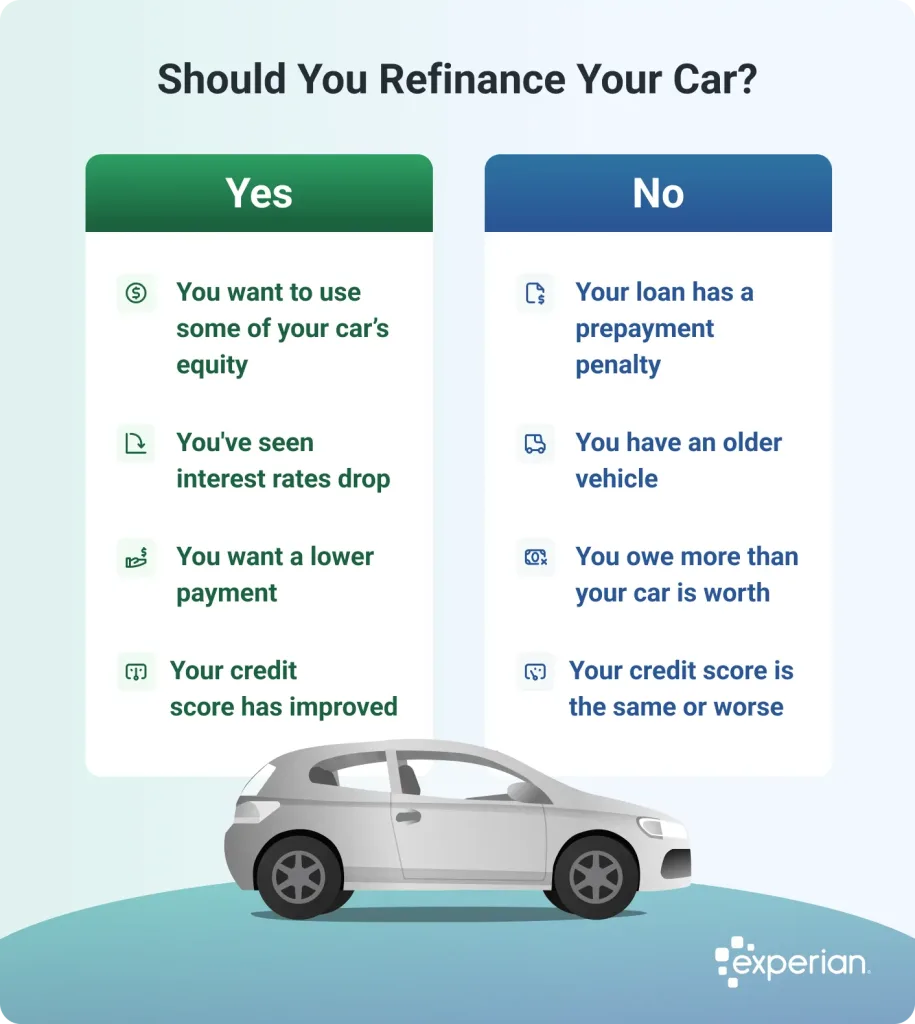

5. When You Should NOT Refinance Your Car Loan

Refinancing is not always a good idea.

❌ Avoid Refinancing If:

1. You’re Near the End of Loan Tenure

Most interest is already paid, so savings will be minimal.

2. Prepayment Penalties Are High

Some lenders charge 2–5% foreclosure fees, which can wipe out savings.

3. Car Has Aged Significantly

Older cars have:

- Lower resale value

- Limited refinancing options

4. You Plan to Sell the Car Soon

Refinancing doesn’t make sense if you’ll close the loan shortly.

6. Key Benefits of Car Loan Refinancing

✔ Lower Interest Cost

Refinancing can reduce the total interest paid over the loan period.

✔ Reduced Monthly EMI

Helps manage monthly cash flow better.

✔ Flexible Tenure Options

Choose a shorter or longer tenure based on goals.

✔ Improved Loan Terms

Better customer service, transparency, and repayment flexibility.

7. Potential Drawbacks & Risks

⚠ Refinancing Fees

Includes:

- Processing fees

- Foreclosure charges

- Documentation costs

⚠ Longer Tenure = Higher Total Interest

Lower EMI may increase total interest if tenure extends.

⚠ Credit Score Impact

Multiple loan applications can cause a temporary dip in score.

8. Car Loan Refinancing vs Loan Restructuring

| Feature | Refinancing | Restructuring |

|---|---|---|

| Lender | Usually new | Same lender |

| Interest Rate | Can be lower | Usually unchanged |

| Credit Check | Required | Limited |

| Savings | Higher | Moderate |

9. Step-by-Step Process to Refinance a Car Loan

Step 1: Check Outstanding Loan Amount

Get loan statement from current lender.

Step 2: Compare Refinancing Offers

Compare:

- Interest rate

- Tenure

- Fees

Step 3: Check Foreclosure Charges

Ensure savings exceed penalties.

Step 4: Apply for Refinancing

Submit application with documents.

Step 5: Loan Approval & Disbursement

New lender settles old loan.

Step 6: Start New EMIs

Continue payments under revised terms.

10. Eligibility Criteria for Car Loan Refinancing

Although criteria vary by lender, common requirements include:

- Minimum credit score: 650–700

- Stable income source

- Car age within acceptable limit

- Good repayment history

11. Documents Required for Refinancing

- Identity proof

- Address proof

- Income proof

- Car RC copy

- Existing loan statement

- Bank statements

12. How Much Can You Save by Refinancing?

Example Calculation:

- Loan outstanding: ₹5,00,000

- Old rate: 11%

- New rate: 8%

- Remaining tenure: 4 years

Estimated savings: ₹40,000–₹60,000 (depending on fees)

13. Impact of Refinancing on Credit Score

Short-Term Impact:

- Minor dip due to hard inquiry

Long-Term Impact:

- Improved score with timely repayments

Refinancing done responsibly can strengthen credit health.

14. Refinancing with Same Lender vs New Lender

Same Lender

✔ Faster process

❌ Limited rate reduction

New Lender

✔ Better rates & offers

❌ More documentation

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/ev-loans-ultimate-guide/

15. Common Mistakes to Avoid While Refinancing

- Ignoring foreclosure charges

- Extending tenure unnecessarily

- Not comparing lenders

- Refinancing too late

- Focusing only on EMI, not total cost

16. Frequently Asked Questions (FAQs)

Is car loan refinancing worth it?

Yes, if interest savings exceed refinancing costs.

How soon can I refinance my car loan?

Usually after 6–12 months of loan repayment.

Can I refinance with a low credit score?

Possible, but interest rate may be higher.

Does refinancing affect car ownership?

No. Ownership remains unchanged.

17. Final Verdict: Should You Refinance Your Car Loan?

Car loan refinancing is a powerful financial tool—but only when used wisely.

Refinance if:

- Interest rates have dropped

- Your credit score has improved

- You are early in the loan tenure

- You want better cash flow

Avoid refinancing if:

- You’re near loan completion

- Fees outweigh benefits

- You plan to sell the car soon

Bottom Line:

Refinance with a calculator, not emotions.

Always compare savings vs costs before making the move.

Leave a Reply