Buying a car is a major financial decision for most people. Whether it’s your first car, a replacement vehicle, or a business purchase, securing a car loan can make ownership easier and more affordable. But what happens when your credit score is low?

A low credit score can make lenders hesitant. It affects interest rates, approval chances, and the terms you qualify for. But here’s the good news — a low credit score doesn’t mean “no car loan forever.” You can still get approved, and sometimes, with reasonable rates too.

This article is a step-by-step, practical, and friendly guide to help you understand:

✔ What exactly a credit score is

✔ Why it matters for a car loan

✔ How lenders evaluate applications of car loans

✔ Smart strategies to improve your chances

✔ Tips specifically for people with low credit scores

✔ What lenders expect

✔ Mistakes to avoid while taking car loans

✔ Real-life examples and best practices

By the end of this guide, you’ll know exactly how to prepare, apply, and increase your chances of getting a car loan even with a less-than-perfect credit history.

Let’s get started.

1. What Is a Credit Score — Really?

Your credit score is a three-digit number (typically between 300 and 900 in many countries) that represents how reliable you are at repaying borrowed money.

In India, this is often called the CIBIL score; in the USA, it’s called a FICO score.

Higher Score = Better Loan Chances

- 750+ = Excellent

- 700–749 = Good

- 650–699 = Average

- Below 650 = Low / Needs improvement

A low credit score usually means:

- You’ve missed payments

- You’ve maxed out credit cards

- You have little credit history

- You’ve defaulted earlier

But remember: A credit score is not permanent. You can improve it, and even with a low score, you can still get a loan by preparing well and following intelligent strategies.

2. Why Your Credit Score Matters for a Car Loan

Lenders look at credit scores to understand your risk profile. When you apply for a car loan, they want to know:

✔ Are you likely to repay on time?

✔ Have you used credit responsibly before?

✔ Do you have a history of defaults or late payments?

Your credit score influences:

- Approval or rejection

- Interest rate offered

- Loan amount eligibility

- Required down payment

- Loan tenure and EMIs

A low credit score often results in:

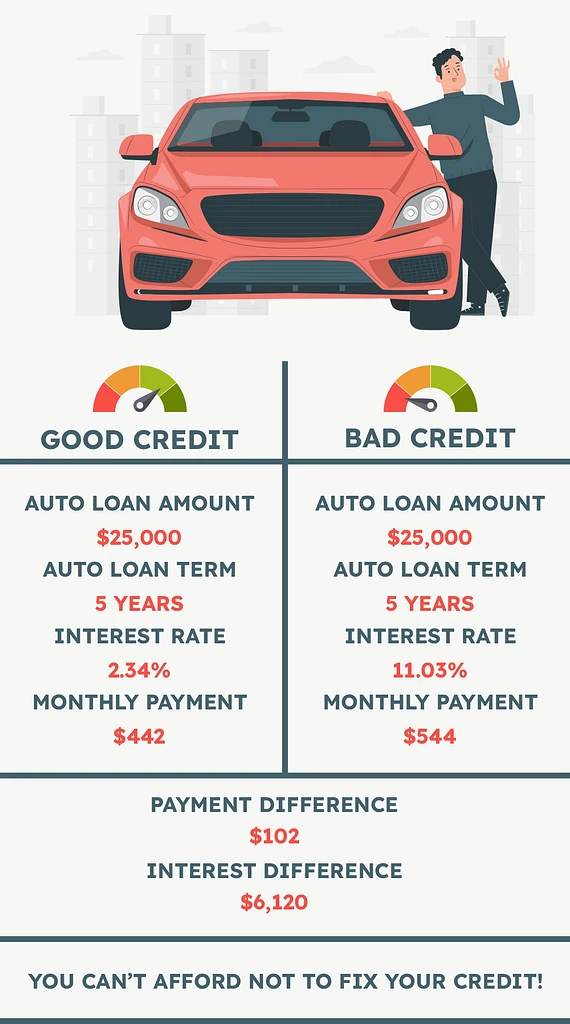

✘ Higher interest rates

✘ Larger down payment requirement

✘ Stricter eligibility terms

✘ More documentation requests

But the score isn’t the only thing lenders consider.

If you want to create AI Ads you can visit: https://adscribe.online

3. 10 Proven Tips to Get Car Loan Approval with a Low Credit Score

Here are practical, tested strategies to boost your chances of getting car loans, even if your credit score isn’t high.

Tip 1: Check Your Credit Report Before Applying

This is the first and most important step.

Your credit report shows:

- Your credit score

- Loan history

- Credit card usage

- Missed payments or defaults

- Loan closures

A key point:

👉 Errors in your credit report can unfairly lower your score.

Ask for a free credit report from the relevant bureau in your country (CIBIL in India, Equifax/Experian/TransUnion in the U.S.).

If you find errors, file a dispute immediately. Correcting mistakes can improve your score fast.

💡 Pro Tip: Always review your credit report at least once a year.

Tip 2: Improve Your Credit Score Before Applying (If Possible)

If you aren’t in a hurry to buy a car, spend a few months improving your credit score. Some of the most effective ways include:

✔ Pay all bills on time (credit card, rent, utilities)

✔ Reduce credit card balances (aim for <30% utilization)

✔ Don’t apply for multiple loans simultaneously

✔ Avoid closing old accounts — keep them for long history

✔ Correct errors in your credit report

Even a small improvement in score can change your loan terms dramatically.

Tip 3: Save a Higher Down Payment

This is one of the most powerful strategies to secure approval with a low credit score.

Why it helps:

- A bigger down payment reduces the loan amount

- Lenders see you as more invested and less risky

- Monthly EMI burden decreases

Example:

Car price: ₹8,00,000

Down payment options:

- 10% → ₹80,000

- 20% → ₹1,60,000

A higher down payment means a lower loan amount and better approval chances even with a low credit score.

Tip 4: Add a Co-Applicant with Strong Credit Profile

If your spouse, parent, or close family member has a strong credit score and stable income, applying with them as a co-applicant can improve your loan viability.

Benefits:

✔ Combined income can increase loan eligibility

✔ Better interest rates may be offered

✔ Lower risk for the lender

Just make sure the co-applicant understands their responsibility — they are equally liable for repayment.

Tip 5: Choose a Shorter Loan Tenure

Longer tenures might reduce your monthly EMI but attract higher risk assessment from lenders when your credit score is low.

Instead:

✔ Choose a shorter tenure if your budget allows

✔ Higher EMIs cause less risk in eyes of lenders

✔ Total interest cost decreases drastically too

Yes — this may mean a higher EMI — but lenders often favor borrowers who ask for shorter tenures.

Tip 6: Consider a Secured Car Loan

A secured loan means you pledge an asset like:

- Fixed deposit

- Property

- Another car

as collateral.

This reduces risk to the lender, making them more willing to approve even with a low credit score.

Secured loans often come with:

✔ Lower interest rates

✔ Higher approval chances

✔ Flexibility in terms

Just be careful — if you default, the pledged asset is at risk.

Tip 7: Apply with a Bank That Knows You

If you have an existing relationship with a bank (salary account, savings account, fixed deposits), they are more likely to approve your loan — even with a low score.

Why?

Banks prefer borrowers they already know and trust.

Talk to your branch manager and inform them of your situation. Sometimes internal relationships carry weight.

Tip 8: Improve Your Debt-to-Income Ratio (DTI)

Lenders calculate DTI as:

Your monthly debt payments / Your monthly income

If your DTI is too high, lenders see you as risky.

To improve your DTI:

✔ Pay off existing smaller debts

✔ Avoid new debts before loan application

✔ Increase your documented income (bonus, rent, freelance)

A better DTI improves your loan approval odds even with a lower credit score.

Tip 9: Provide Accurate and Complete Documentation

Nothing frustrates a lender more than incomplete or inconsistent paperwork.

Make sure you have:

✔ Identity proof

✔ Address proof

✔ Income proof (salary slips / ITR)

✔ Bank statements

✔ Employment proof

✔ Co-applicant documents (if any)

Incomplete documentation often leads to delays or outright rejections.

Tip 10: Use Pre-Approved Offers If Available

Many banks and finance companies offer pre-approved loan offers (based on your existing profile or credit history).

A key advantage of pre-approval:

✔ Higher chance of final approval

✔ Transparent interest rate and terms

✔ Simplified documentation

Even with a low credit score, sometimes pre-approved offers from your existing bank work better than fresh applications with other lenders.

4. What Lenders Look for Beyond Credit Score

A low credit score doesn’t automatically mean rejection — lenders evaluate multiple factors.

1. Income Stability

A steady job or consistent business revenue signals repayment capacity.

2. Job Tenure

Longer tenure at current job or business increases confidence.

3. Debt History

If existing debts are under control, lenders see you as more responsible.

4. Down Payment Readiness

A strong down payment lessens the risk for the lender.

5. Co-Applicant Strength

A co-applicant with solid credit history adds credibility.

6. Bank Relationship

Existing customers often get preferential consideration.

5. 2026 Market Trends: Car Loans & Credit Scores

What’s happening with interest rates, lender policies, and credit scoring in 2026?

1. Interest Rates Remain Moderately High

Central banks globally have tightened monetary policy for inflation — this affects auto loan rates a bit.

2. Fintech Lenders Are More Flexible

Online lenders and fintech platforms have started considering alternate credit data — such as bill payments, savings behavior, and digital footprint — beyond traditional credit scores.

3. Used Car Loans Are Easier

Especially with certification and warranty, secured used car loans with low scores are increasingly approved.

4. Special Schemes for First-Time Buyers

Manufacturers often partner with lenders to provide structured schemes for buyers with less credit history.

This means your loan choice in 2025 needs a strategic plan beyond just the credit score.

6. Real Example Scenarios (With Numbers)

Scenario A: Low Score (620), But Strong Income & Down Payment

Car price: ₹8,00,000

Down payment: ₹2,00,000

Loan amount: ₹6,00,000

Interest rate (negotiated): 12%

Tenure: 5 years

EMI: ~₹13,300

Lender approves because:

✔ Down payment is high

✔ Income is stable

✔ DTI is healthy

✔ Credit history is acceptable

Total interest paid: ~₹1,19,800

Total repayment: ~₹7,19,800

Compare this with a scenario with no down payment — the interest and EMI would be significantly higher.

Scenario B: Low Score (630), Co-Applicant With Good Score

Car price: ₹10,00,000

Loan amount: ₹10,00,000

Interest rate: 11%

Tenure: 5 years

EMI: ~₹21,700

Approved due to:

✔ Strong co-applicant credit score

✔ Combined income high

✔ Low DTI

Total interest paid: ~₹3,02,000

Total repayment: ~₹13,02,000

This is a typical case where adding a co-applicant made approval possible despite a low personal score.

7. Mistakes to Avoid When You Have a Low Credit Score

Even if you follow the tips above, avoid these common errors:

❌ Applying to Multiple Lenders at Once

This triggers multiple credit inquiries and lowers your score further.

❌ Hiding Past Defaults or Errors

Provide transparent details — lenders can pull reports themselves.

❌ Ignoring Loan Cost Beyond EMI

Compare total interest paid — not just EMI.

❌ Choosing Maximum Loan Purposefully

Never stretch loan eligibility just because you were “approved.”

❌ Ignoring Future Income Changes

Plan for conservative future income — don’t assume raises.

8. How to Rebuild Your Credit Score After a Low Score Loan

Getting a loan doesn’t mean your credit score has to stay low.

1. Always Pay EMIs On Time

This is the fastest way to repair credit.

2. Keep Credit Utilization Low

Credit cards should be less than 30% utilized.

3. Avoid Multiple Loans in Short Time

Space out loan applications.

4. Review Credit Report Regularly

Fix errors immediately.

5. Use Mix of Credit

Having some good loan history and credit card activity improves score.

Over time, consistent good behavior can raise your score above 700 — making future loans easier and cheaper.

You can also read our other loan related blogs, please visit: https://loans.fundicainvestments.com/zero-down-payment-car-loans-hidden/

9. FAQs (Frequently Asked Questions)

1. Can I get a car loan with a credit score below 600?

Yes — but it’s harder. Down payment, co-applicants, secured loans, and documented income help.

2. Will a low credit score ruin my chances forever?

No. You can still get loans — and improve your score over time.

3. Are used car loans easier to get with low credit?

Often yes — especially with certified pre-owned cars and warranties.

4. Should I pay down debt before applying?

Absolutely. Reducing existing debt improves your chances significantly.

5. Can online lenders help when banks reject?

Yes — many fintech lenders are more flexible with credit criteria.

10. Conclusion — You Can Get a Car Loan Even with Low Credit Score

A low credit score does not mean “no loan ever.” In fact, many successful car loan takers(borrowers) start with scores below 650 and go on to secure loans — even with good terms.

The real secret is not just credit score—it’s preparation, strategy, and clarity.

Here’s what really matters:

✔ Understand your credit report

✔ Improve what you can before applying

✔ Show strong income & low debt

✔ Save a higher down payment

✔ Add a responsible co-applicant

✔ Provide complete documentation

✔ Negotiate smartly

With the right approach, you don’t just get approved—you get a car loan with terms that serve your lifestyle and financial health.

Getting approved for a car loan with a low credit score is challenging, but absolutely possible — if you approach it with the right plan.

Leave a Reply